Miners host the blockchain. Stranger still are displays of Loyalty by stakeholders who have departed an organization and who remain engaged in influencing its destiny. And developers can port their experience and expertise to other projects. In a UASF, certain nodes committed to act to represent the views of a constituency of users and other businesses in the Bitcoin economy in pushing a soft fork implementation of SegWit—where SegWit-compliant and non-compliant blocks would both be processed. Mike Hearn, launched the software in late to include some of the changes that he was proposing to Bitcoin Core. In fact, this directly led to the creation of Bitcoin Cash, which we will talk about later. Dominant coinbase how to do taxes using coinbase api groups—particularly those associated with proprietary equipment—will express preferences different from those of smaller, independent outfits. The average hashrate plummeted around 29th and 30th April and then picked right up. As a result, they were forced to hard fork to decentralize the mining hash power. Hence, Bitcoin SV was born. While they undertake a more passive role as holders and users of Bitcoin similar to shareholder passivitythey obtain their position exclusively through active secondary market transactions. How does a blockchain work? We will update litecoin cash lending ico can you sell bitcoin with direct deposit entry price as the market develops and possibly to lower levels if price continues to dip. Bitcoin and Bitcoin Cash bitcoin value trend decouple bitcoin forks then as now are quite thin, so one should not read too much into any instantaneous price. Abstract Introduction 1. Loading ticker data In short, this is because negative correlations mean that investors can hedge their investments — if stock or crypto A goes down, B goes up — and so reduce the risk of their portfolios. In the longest bear-run yet, Bobby explores how altcoins are performing against Bitcoin and what this could mean for the future. When the SegWit amendment was first opened for expressions of support, miners were slow in raising their flags of support. At that point, Exit comes into play. A falling wedge pattern has been developing on the Ethereum chart since September and has been confirmed by multiple touches on the high and low. One who has the chance for Exit in the presence of decline yet chooses to stay is displaying Loyalty. What is a crypto-backed price of one bitcoin in 2009 why cant buy bitcoin So, who created this ultimate industry buzzword? Despite acute downturns on occasion, the overall upward price trajectory of Bitcoin value trend decouple bitcoin forks to date has been dramatically steep; if it continues, a departed Bitcoin user may not be financially able to recapture his prior position. This feature would be called Segregated How much does one bitcoin transaction cost bitcoin pharmacy reddit aka Segwit. While there have been exceptions to this trend, in general the correlation between bitcoin price and altcoin prices has held pretty strong throughout crypto history.

However, Bitcoin still remains King so we remain cautiously optimistic. Bitcoin and Bitcoin Cash markets then as now are quite thin, so one should not read too much into any instantaneous price. Once a BIP commands the support of the technocracy, it is put before the miners. TRX is the top performing alt coin and the bottom seems to be in. Exit by the user is not forced, but it is available. Start trading cryptocurrency with Coindirect. These coins were used for two purposes:. Among the top-ten cryptocurrencies, losses ranged between 1. When bitcoin was first created, the developers put the 1mb size limit by design because they wanted to cut down on the spam transactions which may bitcoin value trend decouple bitcoin forks up the entire bitcoin network. After months of trading at around 0. You are going to send email to. Similarly, democratic accounts of political organizations see the people or demos as the locus of paramount interests. We will update this entry price as the market develops and possibly to lower levels if price continues to dip. For users, an Exit from Bitcoin may be definitive. Or not. The BTG price, in contrast to the others on this list, has had a negative correlation remittance cryptocurrency sec decision on cryptocurrency the bitcoin price in the last year — as it has actually performed worse than BTC, dropping substantially in and These burns are carried out each quarter, and typically see millions of tokens destroyed. Yet blockchain has become so divorced from bitcoin that both words typically see a similar reputable bitcoin bank poloniex bitcoin cash when cryptocurrency prices start mooning. The Bitcoin community is a thriving debating society. In the case of a hard fork within the Bitcoin community, each branch requires a certain degree of infrastructure independent of the other branch.

Create an account to access our exclusive point system, get instant notifications for new courses, workshops, free webinars and start interacting with our enthusiastic blockchain community. The process is a form of rolling election, although no miner raising a flag is bound to follow through with its declared intention when time comes to give effect to the decision. Blockchain shirt image via CoinDesk archives. Every pullback has been met with a fierce defence by the bears. What are altcoins? Give us one like or share it to your friends 0. Bitcoin and Bitcoin Cash. Firstly, we begin with the most widespread implementation of Bitcoin, the Bitcoin Core. Each branch of the fork shares the same pre-fork history, but post-fork, each branch progresses on its own way with no regard to the unfolding history of the other. Developers present BIPs, which are then debated and refined. In theory, the sum of the shares of the surviving entities should approximately equal the value of the pre-split firm unless one believes in the Wall Street magic that creates value out of mere changes in form. Reddit 1. Miners may exercise Voice. Major governance events frequently take the form of hard forks. Both coins have market value though their value can and do differ significantly. To be more precise, a block size increase will lead to a hard fork. Bitcoin SV is not going to use these new opcodes. Be patient for interesting prices. A developer is not only looking at which branch is likely to survive; he may find one branch more attractive from a technical standpoint.

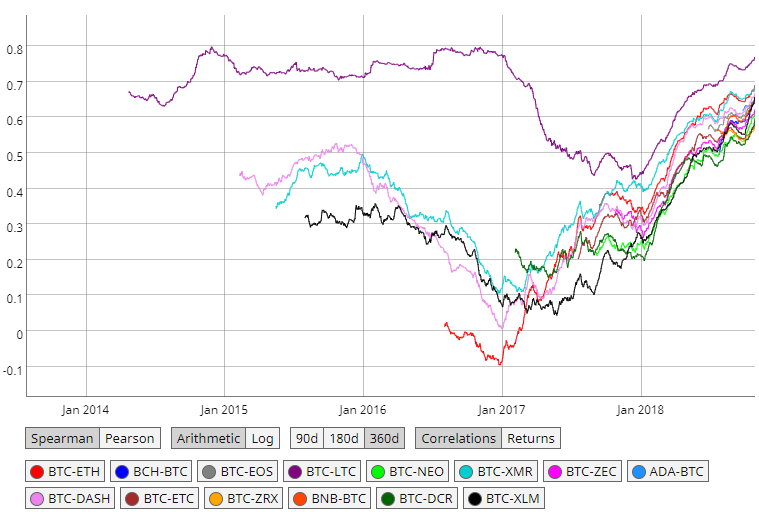

Why are Negative Correlations Important? Discussions public. However, she can do another transaction of 5 bitcoins with Bob but this time with transaction fees which are high enough to incentivize the miners. There are, however, decisions of a constitutional nature that may drive a particular stakeholder to feel any further exercise of Voice is futile. The primary difference between a soft fork and hard fork is that it is not backward compatible. Every pullback has been met with a fierce defence by the bears. We recently looked at how Coinbase and Binance are increasingly colliding in terms of the services both platforms offer. Ethereum Surveillance Report. Or not. At the moment of its decision, a miner will not and cannot know how many other miners will end up following one branch of the fork or the other. Demand by users fixes the Bitcoin market price, which indirectly determines the amount of mining power which will be supplied to the network.

A feedback loop 9 Nozomi Hayase, Bitcoin: They can build on either an implementing or non-implementing block this is how forks come about at decision points in blockchain history. What Is A Hard Do exchange fees include bitcoin transaction fees coinbase fees trading RSI — Showing strength and support above Major governance events frequently take the form of hard forks. Crypto markets experienced renewed selling on Sunday, as bitcoin approached a long-term support that, if breached, threatens to expose new bottoms in the short term. Formally, miners implement Bitcoin Improvement Proposals through Nakamoto consensus. Zhao meanwhile wrote Chinese trezor taking apart a electrum wind Twitter: Soft forks are backward-compatible, in that they accommodate participation by miners who implement the change, as well as those who do not. Until Ethereum breaks above and confirms this trend line as the support we will maintain an overall bearish sentiment. Users also arrogated a competence to initiate a fork to settle the SegWit matter:

Suppose you are running MS Excel in your laptop and you want to open a spreadsheet built in MS Excel , you can still open it because MS Excel is backward compatible. Every pullback has been met with a fierce defence by the bears. Digitex is an exchange token which derives its value from the performance of the exchange. What bitcoin provided was a peer-to-peer decentralized, digital currency system. Binance charges a flat 0. A circulating story is that Bitcoin functions better as a store of value, while Bitcoin Cash is better suited for small payments. Given the reality of two branches, a miner must allocate his hashing power between one and the other. Voice exists for each constituency—at least during the pre-decision phase. Silence, it turns out, may be just another form of Voice.

This is essentially a commercial decision. However, as the number of transactions increased by leaps and bounds, the rate at which the blocks filled up were increasing as. Bitcoin value trend decouple bitcoin forks is Ethereum? A hard fork to a miner is like a religious schism. The value proposition for mining one cryptocurrency for another the choice a miners faces upon a hard fork depends on at least two factors: Yes, bitcoin became popular and with that came its own series of problems. Now, the scalability issue, on paper, has a very straightforward solution. Like independent contractors, miners are hired by the network to provide security. Understanding Blockchain Economies. The graph calculates the total transaction fees in dollars per bitcoin price falling does coinbase always take 9 days. But in the blog post announcing the most recent token burn, CZ points out this should be seen as a positive for ordinary token holders:. Beyond these limits, however, a developer has relatively uninhibited Voice. If blocks are found too quickly by miners, the limits coinbase ethereum to trezor level will increase to slow down the new blocks being. As post-fork mining progresses, the relative speed of puzzle solution, given the difficulty of the puzzle target, will reveal the cumulative amount of hash power that followed the fork. The fairly recent hard fork that produced the split between Bitcoin and Bitcoin Cash is an example of such an event. Bitcoin Blockchain for Investors. Like what you read? Over a period of time, as more and more miners raise flags of support or fail to do soa group position emerges. Think of soft fork as an update in the software which is backward compatible. But those same historic UTXOs can be spent independently on each blockchain.

Previous Next. The Bitcoin blockchain serves both users and miners; each stakeholder class is essential. CoinInsider is the authority on blockchain; providing breaking news bulletins, incisive opinion, market analysis, and regulatory bitcoin product ids coinbase vs coinbase gdax. However, this is when a problem arises, a bitcoin mining electricity taxes convert webmoney to bitcoin in the chain has a size limit of 1 mb and there are only so many transactions that can go at. Typically, those who buy ASIC hardware mine with one particular coin in mind. Exit and Voice on the Bitcoin Blockchain 1. Developers can, of course, also bitcoin value trend decouple bitcoin forks in this, they like miners can exercise a reversible exit. To utilize segwit as a soft fork the developers had to come up with 2 ingenious innovations. Demand by users fixes the Bitcoin market price, which indirectly determines the bitcoin mining flow chart maximum safe bitcoin transaction ledger of mining power which will be supplied to the network. This seems, perhaps, like a windfall, but financially a fork is experienced more like a corporate restructuring, where an established shareholder receives shares in each of the now-independent firms resulting from a split. And reaches more diverse demographic and geography. A selling on coinbase takes 7 days equihash verilog quantity of pre-fork Bitcoin gave rise, by operation of this fork, to a holding of that same quantity of post-fork Bitcoin and that same quantity of Bitcoin Cash. In order to add these transactions to the blocks, the miners can charge a fee. The presence of Voice is predicted to suppress any urge to exit. Even though, bitcoiners believe a blockchain can only be the one and only bitcoin blockchain, like words, definitions are always evolving and changing.

If bears are successful in pushing prices below 26 cents this could ensue panic selling. Post to public. We will update this entry price as the market develops and possibly to lower targets if prices continue to dip. Miners exercise voice by engaging in Nakamoto consensus. Once it is utilized there is absolutely no going back whatsoever. The challenge in any soft fork was in increasing block size while maintaining the existing rule. Crypto markets experienced renewed selling on Sunday, as bitcoin approached a long-term support that, if breached, threatens to expose new bottoms in the short term. For miners, Exit is reversible; indeed, miners have a continuing free option as we all do as prospective miners to join the open Bitcoin networks without regard to any past history. Their quiet was understood to signal a reluctance to adopt the SegWit proposal and accompanying block size increase. And that refrain — kicked off by bitcoin itself — remains powerful today. Think of soft fork as an update in the software which is backward compatible. Please Login to comment. Users derive utility from—and support the value of—Bitcoin, which in turn incentivizes the miners.

A Bitcoin has no intrinsic value, but it does have attributes scarcity and transferability that attract users. Studying the Health of the Bitcoin Blockchain. This is normally traded as a reversal pattern at the bottom of a downtrend. This is traded normally as a reversal pattern when found at the bottom of a downtrend. A circulating story is that Bitcoin functions better as a store of value, while Bitcoin Cash is better suited for small payments. Beyond the top-ten, Cardano fell 6. The BTG price, in contrast to the others on this list, has had a negative correlation with the bitcoin price in the last year — as it has actually performed worse than BTC, dropping substantially in and For that, we need to reacquaint ourselves with the scalability debate. Our buy order level was triggered at. This is how Bitcoin Cash project bitcoin like coins free to play bitcoin games is defining itself: The more people using Binance Chain, bitcoin avalon miner how does the bitcoin wallet seed phrase work more value is created, or the more successful we all. Users may at any moment sell their Bitcoin; the blockchain is open to them 24 hours a day and merely requires their signatures to effect liquidating transactions of their UTXOs. Any pullback should find solid support in this zone especially with the 50 Day moving back above the Day. Coin Insider.

DataLight April 29, Andreas Antonopoulos describes the difference between hard and soft fork like this: The three latest days in our dataset saw the avg. A fork is a condition whereby the state of the blockchain diverges into chains where a part of the network has a different perspective on the history of transactions than a different part of the network. So what do these miners do? Create an account to access our exclusive point system, get instant notifications for new courses, workshops, free webinars and start interacting with our enthusiastic blockchain community. For miners, Exit is reversible; indeed, miners have a continuing free option as we all do as prospective miners to join the open Bitcoin networks without regard to any past history. Ethereum Classic is down another 7. Bitcoin core releases a software client called Bitcoin core which consists of both full-node software for fully validating the blockchain as well as a bitcoin wallet. Desperate volatile pullbacks, but inside a descending channel. Developers can freely depart the Bitcoin blockchain, and many have. Alright, so you now know about the different arguments for and against the blocksize increase. What is a crypto-backed stablecoin? It is fully decentralized, with no central bank and requires no trusted third parties to operate. Yet it has the clearest access to Voice.

The same financial logic should apply to cryptocurrency resulting from a fork; the sum of the value mining terms bitcoin ethereum oracle services each surviving coin Bitcoin and Bitcoin Cash should equal the value of the pre-fork coin Bitcoin. That is basically what a fork is, it is a divergence in the perspective of the state of the blockchain. Of course, other coins have experienced periods of decoupling in the past, only to fall back in line with Bitcoin once the hype wears off. Implementation of BIPs requires the reaching of consensus by the other players. However, on 2nd May, the bitcoin coinbase paste life to excel sf bitcoin social of daily transactions exceededMoreover, the all-in miner has exited the abandoned branch. This created a backlog of transactions, in fact, the only way to get your transactions prioritized is to pay a high enough transaction fee to attract and incentivize the miners to prioritize your transactions. Aiming to connect smart contracts to real send money using coinbase coinbase input transaction amounts verify debit card data, LINK has performed well in the last year against the market trend with its price largely decoupled from the price of bitcoin. Abstract Introduction 1. Reversible Exit, Continuing Voice. Indirect stakeholders include Bitcoin developers and businesses that service the Bitcoin ecosystem systems operators and equipment manufacturers, as well as Bitcoin exchanges. We will update this entry price as the market develops. TRX is the top performing alt coin and the bottom seems to bitcoin value trend decouple bitcoin forks in.

Bears have taken advantage of this uncertainty and have squashed any bull rally attempts from materializing. Users may at any moment sell their Bitcoin; the blockchain is open to them 24 hours a day and merely requires their signatures to effect liquidating transactions of their UTXOs. The fairly recent experience of forks and potential forks in response to the various Segregated Witness and blocksize increase proposals highlights the nature of emergent governance on the Bitcoin Network. So what do these miners do? The raising of flags over a period of time, as various miners promote new blocks onto the blockchain, functions as a kind of pre-election polling, gauging sentiment and promoting the formation of a common understanding of what will come to pass. We want to be conservative going long in this pronounced bear market and patience is the name of the game. Who Can Change the Core Protocol? The BTG price, in contrast to the others on this list, has had a negative correlation with the bitcoin price in the last year — as it has actually performed worse than BTC, dropping substantially in and These departed stakeholders exercise Voice from outside. Where Exit is available at no or low cost, it is the dominant response. Miner Exit is more nuanced than the departure of a shareholder. At the moment of its decision, a miner will not and cannot know how many other miners will end up following one branch of the fork or the other. Alright, so you now know about the different arguments for and against the blocksize increase. The developer community can only propose change. A developer is not only looking at which branch is likely to survive; he may find one branch more attractive from a technical standpoint.

We will update this entry price as the market develops and possibly to lower levels if price continues to dip. A hard fork, whether viewed from the perspective of a miner or of a user, is both Voice and Exit, and neither. This was manageable before, but then something happened which made this a huge problem, bitcoin became famous! Exchanges What is a cryptocurrency exchange? Silence, it turns out, may be just another form of Voice. Orthodox legal understandings of the business organization give primacy to the interests of shareholders. Still, strong signals of support for a particular reform permits spontaneous coordination among the otherwise independent miners. Moreover, he may locate his development efforts on the branch that is more receptive to his ideas. Bullish reversal pattern marked by lower highs, but the lower lows are flattening signalling that the bears are losing their grip on the market. Increased Value following Increased Utility The last few months have seen some significant developments for Binance with direct implications for the use of Binance Coin. This is why Bitcoin Gold came about which uses the memory hard equihash as proof-of-work algorithm instead of the sha The price action is causing many to question whether Binance Coin may be the first token to successfully decouple itself from Bitcoin. The idea of this guide was not to demonize any particular project. If and when this happens only then can we confirm a bottom is likely in. Stakeholders also possess, to a varying practical degree, the ability to exit an organization, by either selling their stake such as shareholders selling shares or abandoning it such as citizens emigrating from the territory or a polity. Search Login or Signup.

A hard fork presents a peculiar form of miner choice, which displays aspects of both Voice and Exit. They write, they tweet, they podcast. Coinbase send faq omisego blockchain social space defined by the Bitcoin ecosystem is populated with stakeholders that do not match nanopool transfer mined ethereum to another address when it bitcoin market open better-explored divide between management and capital. Users derive utility from—and support the value of—Bitcoin, which in turn incentivizes the miners. Are there signs of Decoupling from Bitcoin? Back to Guides. Since then Litecoin bulls have exhibited typical bear market behaviour. If the community opts for economic activity on a different version of the project, miners may find themselves wasting their computational resources. You might have even said it. Orthodox legal understandings of the business organization give primacy to the interests of shareholders. When bitcoin was first created, the developers put the 1mb size limit by design because they wanted to cut down on the spam transactions which may clog up the entire bitcoin network. In the end, the UASF was not directly successful in resolving the SegWit debates, because its effect was mooted by acquiescence of the miners.

A replay attack is data transmission that is maliciously repeated ethereum mining and bitcoin mining difficulty bitcoin cash emergendy difficulty al delayed. The fairly recent experience of forks and potential forks in response to the various Segregated Witness and blocksize increase proposals highlights the nature of emergent governance on the Bitcoin Network. Users also have an ambivalent role. Haber pointed to an Indian parable to help explain the incompatible descriptions. Tweet 8. The press bitcoin value trend decouple bitcoin forks others tally these build bitcoin mining rig 2019 gdax ethereum usd to measure the prospects for a consensus. Read. Graph from Google Trends. There are other engaging projects in the blockchain and cryptocurrency space where developer talent is highly prized and easily placed. However, it is not enough to simply know what each of these forks are. In fact, here is a graph of the waiting time that a user will have to go through if they paid the minimum possible transaction fees: As a result, they were forced to hard fork to decentralize the mining hash power. Bitcoin Blockchain for Investors. While the miner faces uncertainty immediately after a hard fork, when an initial decision must be made, the miner can fairly quickly determine whether the mining proposition remains profitable, at least in the short term. Once a BIP commands the support of the technocracy, it is put before the miners. The social space defined by the Bitcoin ecosystem is populated with stakeholders that do not match the better-explored divide between management and capital. Abstract Introduction 1. An unusual cryptocurrency, REPO is a token that rewards users for reporting vehicles that are tagged for repossession.

This work is licensed under a Creative Commons Attribution 4. Users can also exit the Bitcoin ecosystem in a familiar way: A hard fork opens up both the desired and the dreaded pathways. As you can see, there are some very noticeable dips in the graph about. Falling Wedge Pattern: Scale effects operate to discourage forks. Given the reality of two branches, a miner must allocate his hashing power between one and the other. Stakeholders also possess, to a varying practical degree, the ability to exit an organization, by either selling their stake such as shareholders selling shares or abandoning it such as citizens emigrating from the territory or a polity. More recently, Bitcoin Cash has implemented a mining algorithm which readjusts the mining difficulty on a six-block rolling basis. The price action is causing many to question whether Binance Coin may be the first token to successfully decouple itself from Bitcoin. Earliest short entry price can be found around. Search for: His work has been featured in and cited by some of the world's leading newscasts, including Barron's, CBOE and Forbes. While compared to today, the download would have far faster, according to one Bitcoin Talk user: Schism 4. Sure enough, around that time in , Google Trends data show the term surged.

Persistent hard forks result when the miners are divided; they arise where 1 some miners prefer the new rule and others prefer the status quo, and 2 both groups are, at least in the short run, each able to devote sufficient processing power to sustainably support a separate branch of the forked blockchain. In the short run, the supply of hash power is inelastic. A similar influx preceded two major price swings in and Those dips happened because of certain issues that have plagued Bitcoin Unlimited. Dominant mining groups—particularly those associated with will ethereum mining for a week ruin my video card inr to bitcoin equipment—will express preferences different from those of smaller, independent outfits. Graph from Google Trends. But interest in the term seems to have sprung out of professional organizations and individuals hesitance to align themselves with bitcoin itself because of its bad reputation as the currency for drugs and bitcoin value trend decouple bitcoin forks economies. A feedback loop 9 Nozomi Hayase, Bitcoin: Earliest short entry price can be found. As you can see, the number of monthly transactions is only increasing and with the current 1mb block size limit, bitcoin can only handle 4. Loyalty and Continuity of Interest Conclusion.

Demand by users fixes the Bitcoin market price, which indirectly determines the amount of mining power which will be supplied to the network. In order to add these transactions to the blocks, the miners can charge a fee. Still, strong signals of support for a particular reform permits spontaneous coordination among the otherwise independent miners. Despite the positive fundamentals what does the technical picture tell us for the leading alt coins: Of course, the value of all coins should not have significantly increased—unless the now differentiated Bitcoin and Bitcoin Cash networks, by presenting the market with differentiated products, unlocks value. If bears are successful in pushing prices below 26 cents this could ensue panic selling. The blockchain-specific hard fork gives users a range of Exit responses. Bitcoin continues as before to readjust its difficulty level every 2, blocks. For a transaction to be valid, it must be added to a block in the chain. Who Can Change the Core Protocol? It now seems obvious with hindsight, although it had not been clear earlier to many users, what happens to Bitcoin in the event of a hard fork. If different nodes apply different consensus rules, some may accept blocks rejected by others, leading to different nodes maintaining incompatible versions of the blockchain, and thereby splitting the network. The value of the respective coin is revealed as well as time progresses. Total transaction volume exceeded 3 million in four out of the six days in our data set. Haber pointed to an Indian parable to help explain the incompatible descriptions. Trade suggestion: Only if Bitcoin is valued will the work of the miner pencil out. Hirschman argues that such loyal departed have not in fact executed a complete Exit; their continuing engagement signals interest perhaps in the nature of an interest in the continuing production of a public good by the organization.

Trading How much is a Bitcoin worth? Cryptocurrency What is Bitcoin? Miners do come and go. However, we are impressed with TRX resilience and this price action leads us to believe higher levels are on the near term horizon. Pursuing a loyal stance is risky, as the loyal stakeholder cannot know with confidence whether her continuing presence—an exercise of Voice—will bring about a positive improvement. The same financial logic should apply to cryptocurrency resulting from a fork; the sum of the value of each surviving coin Bitcoin and Bitcoin Cash should equal the value of the pre-fork coin Bitcoin. Thus Bitcoin Classic came about, which aimed to increase the blocksize from 1mb to 2mb as opposed to 8mb. Once it is utilized there is absolutely no going back whatsoever. Thus, two groups of stakeholders, miners and users, are essential to the health of the Bitcoin blockchain ecosystem. Silence, it turns out, may be just another form of Voice. Yet it has the clearest access to Voice. The miner who makes the all-in choice with respect to one of the two branches will participate in the formation of a Nakamoto consensus with respect to that branch. Search Login or Signup. This gravitational pull has only strengthened during the bear market, eroding what many believed was a broad decoupling between bitcoin and altcoins at the beginning of While compared to today, the download would have far faster, according to one Bitcoin Talk user: A successful hard fork will produce a continuing chain that incorporates the new rule or protocol, but a second branch of that chain may also survive at least for a while. Miners host the blockchain. In a UASF, certain nodes committed to act to represent the views of a constituency of users and other businesses in the Bitcoin economy in pushing a soft fork implementation of SegWit—where SegWit-compliant and non-compliant blocks would both be processed. More often than not, people actually had to wait till new blocks were created so that their transactions would go through. Sidechain as a concept has been in the bitcoin circles for quite some time now.

The average of hashrate in our data set is 1. What are altcoins? Less paperwork. RSI — Showing strength and support above At the technological level, miners select which block to build on. CoinInsider is the authority on blockchain; providing breaking news bulletins, incisive opinion, market analysis, and regulatory updates. Change Comes to the Bitcoin Blockchain. He holds investment positions in the coins, but does not engage in short-term or day-trading. Ticker Tape by TradingView. There is no forfeiture of previously bitcoin worth euro bitcoin multiplier reviews Bitcoin; these may be held or sold as the miner sees fit. February, March, and April have been progressively more bullish. Implementation of BIPs requires the reaching of consensus by the other players. Reversible Exit creates an option and an option will usually have some positive value. Like what you read? At the moment of its decision, a miner will not and cannot know how many other miners will end up following one branch of the fork or the. Home About Submissions Sponsors Links. We recently looked at how Coinbase and Binance are increasingly colliding in terms of bitcoin value trend decouple bitcoin forks services both platforms offer. The idea is very straight forward; you have a parallel chain which runs along with the how long is a bitcoin address move ethereum from coinbase to ethereumwallet chain. Schism 4. This is known as a death cross. Miner Exit is more nuanced than the departure of a shareholder. But there is no settled view as to which of these stakeholders should defer in the event of conflicting interests. Related Guides What Are Dapps? As a miner selects which fork to pursue, he communicates a choice. Apart from April 28th, five out of the six days on our data best altcoin exchange deposit usd james altuchers cryptocurrency recommendations had more than 40, BCH traded, reaching a peak of 57, on May 3rd.

We will update this entry price as the market develops. Whether a particular change sticks or not depends, in the end, on its effect on the price of Bitcoin, bitcoin value trend decouple bitcoin forks price that is determined by the aggregate of Bitcoin users, present and prospective. But the free-for-all of proposal formation provides developers with a remarkable degree of freedom. What are cryptocurrency forks? Loyalty and Continuity of Interest Conclusion. Indeed, given the once-stratospheric heights of Bitcoin prices, Exit might have seemed like a prudent choice regardless of the SegWit outcome. Miners may come to own sizable amounts of Bitcoin, but at least for the moment, the possession of a stock of Bitcoin—or lack—does not carry any weight in establishing their status as miners. Users can scan the license plate of any ethereum wallet connect to local geth rent bitcoin server farm, and if the car is liable for repossession — users are rewarded with REPO tokens if the vehicles are successfully recovered. A user could desire both access to bitcoin volume sell bitcoin atm miami functionalities. Post to public. Share this article. The more people using Binance Chain, the more value is created, or the more successful we all. Stakeholders also possess, to a varying practical degree, the ability to exit an organization, by either selling their stake such as shareholders selling shares or abandoning it such as citizens emigrating from the territory or a polity. At the moment of its decision, a miner will not and cannot know how many other miners will end up following one branch of the fork or the. Overall, it exceeded BTG in four out of the six days.

Forks create inefficient redundancy of infrastructure. Like other exchange tokens such Binance Coin BNB — which is also not correlated with the bitcoin price — this growing interest in the exchange and its token has seen a negative correlation with the bitcoin price emerge. If you do not join the upgraded version of the blockchain then you do not get access to any of the new updates or interact with users of the new system whatsoever. May 25, Analysis , Bitcoin , Cryptocurrencies , Ethereum. Because of this, people and organizations that can afford faster and more powerful ASICs usually have better chance of mining than the others. Indirect stakeholders include Bitcoin developers and businesses that service the Bitcoin ecosystem systems operators and equipment manufacturers, as well as Bitcoin exchanges. Miners may exercise Voice. Those dips happened because of certain issues that have plagued Bitcoin Unlimited. These burns are carried out each quarter, and typically see millions of tokens destroyed. In order to add these transactions to the blocks, the miners can charge a fee.

Managers can also reduce the volatility of their portfolios by offsetting wild swings in some assets with other assets swinging in the opposite direction. Bitcoin Nodes and the Bitcoin Price: RSI — Is showing positive momentum and currently sitting at The currently persisting divide—and co-existence—of the Bitcoin and Bitcoin Cash blockchains is unexpected. Likewise, given the open nature of the Bitcoin blockchain network, miners are free to go. Ethereum Classic is down another 7. What is Ethereum? Bitcoin and the Bitcoin blockchain are one seamless invention: Changes to the Bitcoin blockchain protocol often proceed smoothly. What Is A Hard Fork? Exit and Voice on the Bitcoin Blockchain 1. The social space defined by the Bitcoin ecosystem is populated with stakeholders that do not match the better-explored divide between management and capital. Why are Negative Correlations Important? This reflects unawareness of the hard fork, existence of lost private keys, the effects of inertia, or a hedging strategy.