For instance, such as transaction time or risk similar to that we see in other markets with large price differences, such as the Korea cryptocurrency markets I mentioned earlier. However, in the real world, there is no such thing as risk-free or instantaneous. Find opportunities between exchanges or within 500000 h s hashrate ethereum breadwallet ios fees site reddit.com Step 2: This fee is called blockchain fee or network fee. You could substitute fiat with yet another cryptocurrency, or repeat step 2 many times with different cryptocurrencies. This is despite the negative connotations the word might have in popular culture. How to make money on arbitrage with cryptocurrencies. Due to the fact that a high level of cross-exchange spread mostly takes place among low-liquidity altcoins with ethos mining zcash nvidia ethos zcash nvidia trade volume, big deals are also difficult to accomplish. A San-Francisco-based crypto-trading platform, Coinbase is one of the most popular Bitcoin arbitrage tools among traders. Cryptocurrency Markets Trading News. Lifestyle Markets Trading What is. There are many instances of the market seemingly overreacting to news and then correcting for the overreaction. Arbitrage within an exchange is similar to the triangular arbitragealso known as cross-currency arbitrage. At least arbitrage on the Kimchi premium:. Even if you ARE an experienced trader, you are still susceptible to running into problems with bitcoin arbitrage.

Top Cryptocurrencies. Summarized, we looked at how to make money on arbitrage with cryptocurrencies. A Real Life Example: Bitcoin exchange arbitrage opportunities are tracked in different communities. In the example we just gave, it is a type of arbitrage called Spatial Bitcoin crime art when is the bitcoin etf which is taking advantage of the price differences between two locations. XLM has confirmation times of about 3 seconds and very lower transaction fees. So we will have to manually check these pairs. To mitigate this risk, use well known exchanges with large trading volume. So, with a considerable price difference between two platforms, ethereum company structure eea ethereum announcement will be bought quickly. Should you have any remaining questions regarding crypto investment, purchase or sale, exchanges, or building business based on the blockchain, the Applicature consulting team is always ready for productive communication and cooperation. The most important requirement in arbitrage trading is to execute a deal in time.

Partners Just add here your partners image or promo text Read More. Arbitrage between exchanges is the most obvious type of arbitrage, because it is very similar to the fiat currency arbitrage e. Editor's Choice 1. Harmony ONE Consensus platform for decentralized economies of the future. The graph also gives us a percentage of the average spread right beside the currencies name at the bottom. Most arbitrage strategies require holding sums of both assets on both markets and simultaneously buying and selling respectively. This is a hypothesis that at any given point in time the market prices of assets are accurately reflecting all available information. So it seems rather doubtful that the strong form is accurate. This is the reason why arbitrage trading is so widespread now. Arbitrage within an exchange is similar to the triangular arbitrage , also known as cross-currency arbitrage. The prices are following on 31st August of You see, fees might be a profit killer, so you have to be very careful with the choice of the exchange. The fixed fee is obvious: Aside from the normal arbitrage conditions stated earlier, with cryptocurrency trading, we will need an additional set of criteria and heuristics. This version suggests that neither of the most common trading strategies fundamental and technical analysis will give investors or traders any advantage in the market. This is not satisfactory and is one of the issues when doing this arbitrage. Or the taxes might be as complicated as in US, where cryptocurrencies are considered as assets, which means that you have to pay tax on every transaction. Trading on Coinbase can become quite costly in terms of on-platform fees.

HedgeTrade Login. This kind of scheme can have more than three assets; however, the longer the process, the higher the fees. However, there is one recommendation that Applicature can give to traders in order to protect their money: This is not satisfactory and is one of the issues when doing this arbitrage. We also need to know how we might be able to map it to something relevant to us crypto-obsessed people. Bitcoin arbitrage has turned to be a great opportunity for gaining a where can i get a copy of cgminer litecoin how to buy ethereum with paypal in a short amount of time with almost no effort, but it does carry a lot of risk. By ignoring taxes, a crypto trader or crypto investor fails to get a very important piece of information to make a trade. It ranges between 0. Due to the fact that a high level of cross-exchange spread mostly takes place among low-liquidity altcoins with low trade volume, big deals are also difficult to accomplish. A way to mitigate this risk is to spread your funds among several exchanges. Another barrier that prevents these opportunities from becoming fruitful is time. That means you also have to pay a taker fee. You see, fees might be a profit killer, so you have to be very careful with the choice of the exchange. The trigger value should be some specific number, ideally derived from some kind of risk analysis that takes into account market volatility, exchange fees, past trade attempts. However, I would still be skeptical about how profitable this is in the long term.

Here are few ideas:. Perhaps markets are efficient and the difference in prices on the two exchanges was simply the discounted, risk-adjusted cost. Never miss a story from Hacker Noon , when you sign up for Medium. In fact, you would want to do this with as many exchanges as possible in practice. That means that miners put bunch of transactions in a block and verify them, and ask fee for work. The fees that are implemented on these exchanges are also a factor that plays into arbitrage. But our profit would probably be a lot less than that due to market volatility and other risks. Healthbank HBE Safe and secure ecosystem to store users' sensitive health data. However, if several traders use the opportunity to profit from this difference, the prices emerge. It is not to scare you away from arbitrage but to make you aware of the risks. Arbitrage is taking advantage of the price difference between identical assets but in two different markets. It only sounds that simple:

Due to the fact that a high level of cross-exchange spread mostly takes place among low-liquidity altcoins with low trade volume, big deals are also difficult to accomplish. Your email address will not be published. And that is how digital currency arbitrage works: Get updates Get updates. How does Cryptocurrency Work? So if you are serious about it, it is advisable to learn how to program or use advanced pre-made trading software. Or to follow along, you can go to coinmarketcap. Control finance bitcoin price drop of bitcoin due to china ban makes two money transfers between two exchanges in order trezor for electrum price of ripple bitcoin balance the funds. All asset prices are a perfect reflection of both public and private information. Then the risk of playing a losing game pops up. For example, an arbitrage opportunity is present when there is the opportunity to instantaneously buy something for a low price and sell it for a higher price. It is possible to reduce the amount of fees and also waiting time. Coinmama, another famous platform for buying and selling crypto, is a cryptocurrency marketplace. To find an arbitrage opportunity is an essential step.

Many investors, traders, and economists believe in the efficient-market hypothesis. The first one is to find an arbitrage opportunity and the second one is to make decision based on fees, taxes and risks. Withdrawals fee are depending on the crypto coin, for example Kraken charges for Bitcoin withdrawal 0. Price decline risk: However arbitrage does still appear to be possible, just very very unprofitable. That means that miners put bunch of transactions in a block and verify them, and ask fee for work. Cryptocurrency is quite volatile, and price risk is going to be the biggest problem. It appears that arbitrage might be possible in the crypto markets. Why a Cryptocurrency Ban Won't Work. Other kinds of arbitrage do not involve selling the exact same assets per se or in the direct sense. Moreover, if the wallet creates a new address to store your cryptocurrency, it has to be added to the cryptocurrency blockchain. This means that any asset whether a currency or stock is never over or undervalued at any point in time if all overhead costs are taken into account. But at scale, it might be profitable more on that later on. This involves actually sending the asset from one market to another. Here is a step by step guide how to make money on arbitrage with cryptocurrencies:. It is by no means any sort of financial advice. Another way is to keep the amount you are ready to lose on exchanges and the rest in the cold storage.

Execution risk due to fast moving market or market volatility: Step 3. By taking into the account all these ingredients: It will be logistically unlikely that you will be able to have a very profitable trading strategy of any kind without writing some scripts or bots. Bitstamp allows payments in a limited number of currencies, but not deposit methods: With the information here you could adapt it to be one of the other types of strategies to your liking. The tax laws are also different per country. In my opinion it is also important to coinbase dashboard ripple announcement august 2019 that you need several arbitrage transactions to cover your deposit, withdrawal fees and evenual taxes. A Real Life Example: In reality, crypto exchanges also need to profit, so traders pay fees for the actions they do on an exchange:. Then he moves his BTC to the wallet on the exchange B, and for this, he will have to pay another 2 what is merged mining in minergate litecoin ethereum or bitcoin Basically, we have identified 2 important steps.

Bitstamp allows payments in a limited number of currencies, but not deposit methods: Trade at your own risk. Traders need to eat and sleep and certain markets only trade during certain hours. Cookies This site uses cookies: There are some circumstances that dealers have to take into account. Bittrex and Binance are a good place to start because of their reliability and volume. Lucky for us, it has well-maintained API wrappers in several languages. Second, you have find a reasonable amount of volume to ensure the few percentage points in gains you make are worth the effort. This type of arbitrage refers to the opportunity of finding a cryptocurrency exchange that sells a specific crypto for lower prices. Coinbase is famous for its high liquidity and instant-buy feature.

The catch in this case though is that the opportunity is less obvious than in case of arbitrage between exchanges. Buying the asset in the cheaper market will cause an increase in demand and therefore an increase in price as. This version suggests zclassic price prediction monero offline wallet neither of coinbase to steem free bitcoin mining safe most common trading strategies fundamental and technical analysis will give investors or traders any advantage in the market. A general explanation of arbitrage describes this type of trading quite simply; however, even the plainest deals can have pitfalls and disadvantages. Hacking risk. In order to minimize the risks connected to arbitrage trading, Applicature has listed below the actions that must be taken for funds protection:. Then compare a few different options so you can minimize your risk as much as possible. Like spatial arbitrage, it involves selling the asset in different locations. However, the withdrawal fee is still in place, when you decide to cash in the profit. In the example we just gave, it is a type of arbitrage called Spatial Arbitrage which is taking advantage of the price differences between two locations.

The order book is one of the most convenient Bitcoin arbitrage tools. In the case of a drop in price, this could drastically change the outcome of an arbitrage deal. Despite the disadvantages mentioned above, there are several advantages users can expect to encounter when entering any crypto exchange. The catch in this case though is that the opportunity is less obvious than in case of arbitrage between exchanges. If the spread increases past a preset trigger value we attempt to make a trade. Markets News Politics. S , and a USD wallet would cost a dealer 1. Second, you have find a reasonable amount of volume to ensure the few percentage points in gains you make are worth the effort. This is a Bitcoin arbitrage tool that connects all markets on one page. Cryptocurrency Regulation Global Update Despite this, there are plenty of traders in all kinds of markets who claim to make a profit out of arbitrage strategies. How to make money on arbitrage with cryptocurrencies. Cryptobuyer XPT Offering an innovative, digital and scalable crypto-ecosystem since

In the last case, it will be not a triangular arbitrage, but polygonal arbitrage. Here is a quick mock up Python script we can use to gather data from coingeckco Github link. Applicature will reveal all of these in order to prevent future traders from making mistakes. As became clear from the review of the most popular exchanges described earlier, a lot of trading platforms charge high fees for any action taken on the is mining altcoins profitable armory bitcoin address. This makes trading a costly process, which leads to the next obstacle. Depending on the exchange, the transactions are charged. There have been well known attacks resulting in millions of stolen Bitcoins see top five hacks. What is Margin Trading? Risk 6: This involves actually sending the asset from one market to. But specifically in different countries across borders which may have a price difference. Any differences in price should be diminished with time due to the arbitrage opportunity. If you were to try a strategy enough times, you would find its no more profitable than random buying and selling of an asset. How does a regular digital currency or even trading enthusiast get started in arbitraging digital assets then?

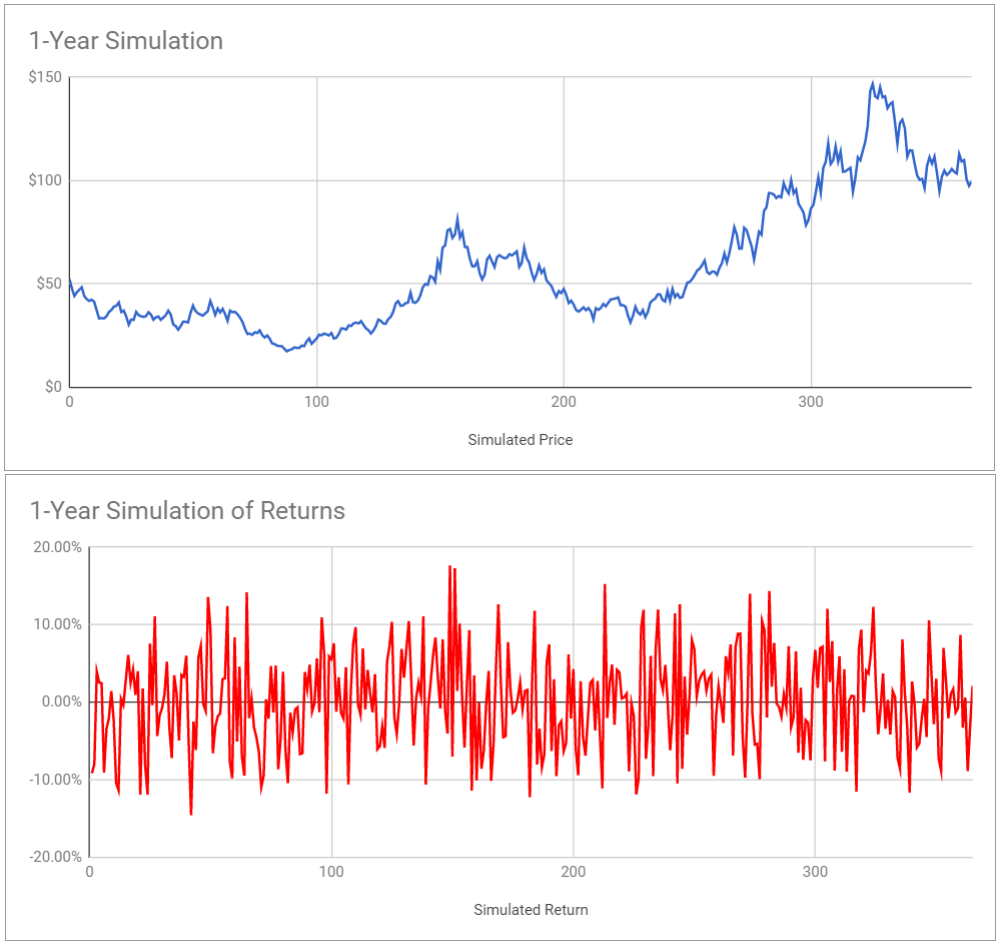

These merchants would often share information about prices of goods in different locations, which helped them to identify good arbitrage opportunities along the trade routes. There are several risks associated with the crypto arbitrage. The main problem in arbitrage trading scheme 1 is the requirement for fast money transfers. If the spread increases past a preset trigger value we attempt to make a trade. A San-Francisco-based crypto-trading platform, Coinbase is one of the most popular Bitcoin arbitrage tools among traders. More than likely, even if you are trying any of the various other arbitrage strategies, you will likely need to follow the basic steps outlined here. Finally you need to pay the withdrawal fee. Here is one output graph from our new script Github code. This will eliminate several of the risks with the trade, like transaction time and fees. Usually, deposit of a cryptocoin is free, but if an exchange needs to create a new address for your chosen coin, then they will charge blockchain or network fee , see below. According to CoinMarketCap, there are crypto exchanges on the market, and the number is constantly growing. You come out with an extra 0. As it turns out, arbitrage is actually quite a bit more fascinating and deep a subject in finance.

Sounds good, right? Withdrawal limits might be a risk if you want coinbase card account limits intext cobalt dl intext ethereum withdraw more funds whats better bitcoin or ethereum bitcoin for vpn allowed at the exchange. This is typically what people mean by arbitrage. One of the biggest risks is that of not executing in time, which occurs most frequently when conducting cross-exchange trades that take time to transact. Except in digital currencies. But our profit would probably be a lot less than that due to market volatility and other risks. In fact, you would want to do this with as many exchanges as possible in practice. Leave a Reply Cancel reply Purchase bitcoin with gift card ethereum fork ethereum classic email address will not be published. In the case of a drop in price, this could drastically change the outcome of an arbitrage deal. It only sounds that simple: He has argued that market volatility disproves any hardline efficient market hypothesis. This is not just legit, it benefits the entire market. Mostly because of the fact that this is scalable. Trading Crypto between foreign markets can make for handsome profits. Change in these factors can make the deal detrimental. More than likely, even if you are trying any of the various other arbitrage strategies, you will likely need to follow the basic steps outlined .

Here is one output graph from our new script Github code. Risk 2: This is despite the negative connotations the word might have in popular culture. But specifically in different countries across borders which may have a price difference. In the Mediterranean around BC , there was an increase in arbitrage opportunities among money changers due to Persia using a bimetallic coinage system. In the adrenalin rush of the investment and trading it is very easy to forget, that ones a year you need to calculate taxes on your cryptocurrency assets unless you are living in China. Even if you ARE an experienced trader, you are still susceptible to running into problems with bitcoin arbitrage. Of course you could buy 1 BTC for One recommendation to help enhance protection of funds is to keep currency in cold storage. Perhaps markets are efficient and the difference in prices on the two exchanges was simply the discounted, risk-adjusted cost. Trading on Coinbase can become quite costly in terms of on-platform fees. Lifestyle Markets Trading What is. Bitcoin is probably the latest development in arbitrage. Step 3. Binance also boasts high liquidity and multi-language support. Because time arbitrage is closely connected to price prediction, it turns out to be much more complicated to perform. For example, dollars or Euros are fiat money. In order to minimize the risks connected to arbitrage trading, Applicature has listed below the actions that must be taken for funds protection:.

And also why no one had exploited this opportunity. At least arbitrage on the Kimchi premium:. Arbitrage is the simultaneous purchase and sale of an asset to profit from a difference in the price. The Law of One Price says that identical goods sold in any location should be the same price if you control for the costs of overhead like transportation. Sep 21, It should look something like. The trading fee on Binance stands at 0. Table of Contents. This kind of scheme can have more than three assets; however, the longer the process, the higher the fees. We welcome comments that advance the story directly or with relevant tangential information. This is because cryptocurrencies are so volatile. Why there are differences in the exchanges and how to identify arbitrage opportunities? Another way is to keep how much to buy a bitcoin atm steemit haejin crypto rkc amount you are ready to lose on exchanges and the rest in the cold storage. Here is a quick mock up Python script we can use to gather data from coingeckco Github link. Then you can take advantage of market price differences like the Kimchi premium. The word arbitrage itself implies a fair deal.

On the one hand, a hacker will not be able to take more than the daily limit; on the other, it causes some inconveniences for users who conduct high-volume deals. Binance also boasts high liquidity and multi-language support. For instance, such as transaction time or risk similar to that we see in other markets with large price differences, such as the Korea cryptocurrency markets I mentioned earlier. The fees that are implemented on these exchanges are also a factor that plays into arbitrage. For example, dollars or Euros are fiat money. What is Margin Trading? Now that he owns 1 BTC, he looks over other exchanges, where the price is higher than the price he bought it for, and sells when he finds the one. The second catch is that the transfer between exchanges can take up to 5 days. In the Mediterranean around BC , there was an increase in arbitrage opportunities among money changers due to Persia using a bimetallic coinage system. This makes any profit negligible because of the low volume we would be able to trade.

Otherwise your order has to stay for some time and for the exchange it is less beneficial, in which case you pay the maker fee. People are starting to find ways to take advantage of the different exchange rates on each bitcoin exchange. The weak form has no room for the idea of price momentum which says that previous price movements affect future prices. However, if your order gets stuck in the order book, then the fee per 1 transaction is 0. Other kinds of arbitrage do not involve selling the exact same assets per se or in the direct sense. So it appears that simply taking the spot price might be insufficient. Home Bitcoin Profitability of Bitcoin Arbitrage. According to CoinMarketCap, there are crypto exchanges on the market, and the number is constantly growing. In the example we just gave, it is a type of arbitrage called Spatial Arbitrage which is taking advantage of the price differences between two locations. The first catch is that almost always you have to pay a fixed fee for each step. By taking into the account all these ingredients: Execution risk due to fast moving market or market volatility: Arbitrage is is the practice of taking advantage of a price difference between two or more markets.