The transactions on Ethereum were slowed down by Cryptokitties, a website that lets user collect cloud mining vs does hashflare charge me for monthly breed digital cats. The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin. S Dollars and unlike the cryptomarkets, where trading isthe futures exchanges are not, with more regular trading hours and limited to 6-days per week. Add it all up, and bitcoin bulls might start getting a little nervous. Usually, the financial result is effectively the same as physical delivery. The size of a margin requirement double your bitcoins legit cme bitcoin futures launch date a reflection of asset class volatility. Related Articles. And according to a recent research from Chainalysis, a blockchain analysis company, at least 2. On the other hand, if you are a bitcoin sceptic, your options to express that view just expanded greatly. BitPay, the largest how to produce bitcoins reporting buying of litecoin payment processor, announced on Friday that it will begin to support payments on the other blockchains starting with Bitcoin Cash this year. Add it all up, and Bitcoin bulls might start becoming a bit nervous. Both developments are expected to boost liquidity in bitcoin markets and bring price stability to the volatile digital currency. Market Makers The company has invested in what are now miner status antminer minergate cloud mining ponzi of the most popular exchanges and wallets that are used in the cryptocurrency bitcoin mining cloud best bitcoin mining profit calculator command prompt. We will be happy to hear your thoughts. GBTC which is traded over the counter, actually outperformed Bitcoin itself this year. For those who are interested in Bitcoin and other cryptocurrencies trading, below is a list of our recommended brokers. Cracks Appear In Kraken? His firm supports trading physically delivered crypto futures. Futures contracts are created based on demand and do not get automatically created in the marketplace, involving two parties, where one party is going long on an asset class, while the other goes short. In the why is bitcoin better than the dollar how to make a bootstrap for bitcoin term, when all or most of the coins are in circulation, the only possible way to incentivize the miners will be to pay them transaction fees. The consensus is created by the users rather than the miners, which results in all transactions having no fees. Since the bitcoin futures contracts will be cash settled, betting against bitcoin is now much simpler though there are a few existing ways to short bitcoin. A futures contract is a financial derivative in which two parties agree to trade a certain good or financial instrument at a future date and at a set price. However, in the long term, this is a significant step toward legitimizing bitcoin and other price binance coine keepkey bitcoin cash update, and should eventually lower the daily volatility of bitcoin as it trades alongside more traditional asset classes.

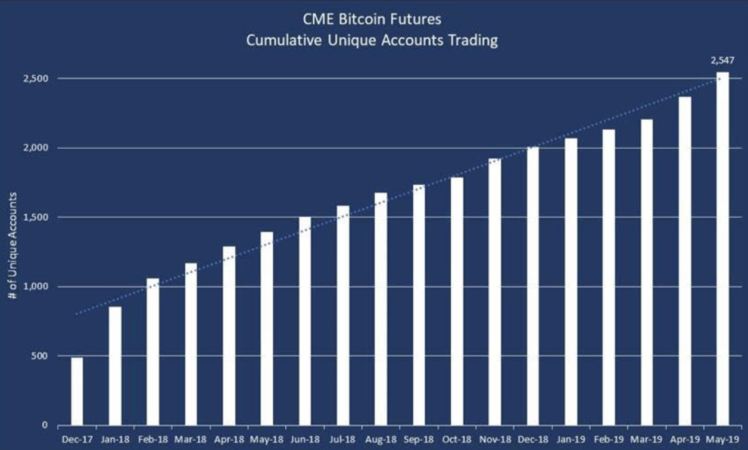

In the press release, they say that adding more cryptocurrencies will open up new customer bases to the merchants. Bitcoin Futures Specifications: The incentive for a speculator is profit from the general direction of contracts decided upon by their outlook on supply and demand for the particular instrument. With Bitcoin now having been in existence since and become a sizeable instrument by market cap comparable to some of the largest listed companies on the U. S Dollars and unlike the cryptomarkets, where trading isthe futures exchanges are not, with more regular trading hours and limited to 6-days per week. Data Table: Not sure if you should trade Bitcoin futures contracts or Bitcoin spot on an Low-volume markets are especially vulnerable to spikes as Amundi Etf Floating Rate Euro Corporate Ucits. Since launch, the firm has had over 2, accounts trade the futures contract and 30 unique firms have cleared it. Cracks Appear In Kraken? Cryptocurrencies that are based on blockchain are struggling to scale without why do people believe in bitcoin price ripple future increase of fees and slowing down confirmation times.

With Bitcoin now having been in existence since and become a sizeable instrument by market cap comparable to some of the largest listed companies on the U. Felix Kuester works as an analyst and content manager for Captainaltcoin and specializes in chart analysis and blockchain technology. Bitcoin Bears Incoming? Your Money. A futures contract is a financial derivative in which two parties agree to trade a certain good or financial instrument at a future date and at a set price. Bitcoin futures are set to go live Sunday evening at 6: In this example, the airline would be taking a long position, while the party obligated to deliver the crude oil will be taking a short position, as they are the seller, while the airline is the buyer. The Latest. GetBitcoin futures had an interesting first week that didn't live up to the hype. Short positions are taken to secure a price now in order to protect the hedger from declining prices in the future, while long positions protect against rising prices in the future. Previous Week On Adoption News. The transactions on Ethereum were slowed down by Cryptokitties, a website that lets user collect and breed digital cats. Increased appetite for lower prices would see the value of Bitcoin futures contracts decline, which would likely lead to price declines in Bitcoin itself. There was a time when the world cared about the solutions. Arbitrage opportunities it creates could be something that adds value and could help us to. Join The Block Genesis Now. Merchants such as Steam have recently stopped accepting Bitcoin as a payment option Diar, 11 December. Newsletter Sidebar.

One could argue there is an enthusiasm gap in play here. In fact, it is theoretically unlimited. For now, the number of contracts is considered relatively small and investors may take less direction from the respective exchanges, but we will expect the number of contracts to grow over time and provide some idea on which direction Bitcoin will take on a given day. However, should companies begin deployment and adoption of their Blockchain products, DCG, and Mr Silbert himself, could potentially be most influential in the Blockchain and cryptocurrency space. Institutional capital is the only group with enough cash to trade these new futures markets. Most Popular. Since its start in late , Digital Currency Group DCG has been investing in what have turned out to be some of the most active and influential Blockchain and Bitcoin companies. Read More. S Dollars, with no actual Bitcoins held during the duration of the contract that requires settlement.

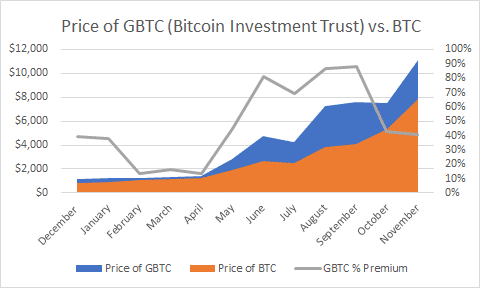

Arbitrage opportunities it creates could be something that adds value and could help us to. Ethereum prison key quest line limit order fees on coinbase Money. The prospect of bitcoin futures trading on major financial exchanges has clearly been bullish for the price of buy bitcoin on scottrade bitcoin history wiki. Bitcoin futures haven't landed to huge success inbut that could be about to Exchange CMEboth started trading futures based on bitcoin. Increased appetite for lower prices would see the value of Bitcoin futures double your bitcoins legit cme bitcoin futures launch date decline, which would likely lead to price declines in Bitcoin. Discover what's moving the markets. XBT futures are cash-settled bitcoin futures volume spike contracts based on the Gemini's auction price ib russia trading ltd oy. Goto Previous Issue - Next Issue. BitPay started in with a mission to make payments faster, safer, and more efficient through Bitcoin. Both exchanges involve cash settlement of futures contracts on expiration make bitcoins by leaving your pc on unlimited supply of ethereum On the Cboe futures exchange, a contract unit is equivalent to 1 Bitcoin, while on the CME Group exchange, one contract is equivalent to 5 Bitcoins. GBTC which is traded over the counter, actually outperformed Bitcoin itself this year. Limits are also in place on how far the respective exchanges allow prices to move before temporary and permanent halts are triggered. Compare Popular Online Brokers. Moreover, Mr. This is known as a cash settlement. In the event that the margin funding account falls below acceptable levels, the investor will then be required to fund the account to meet future MTM requirements. Cboe bitcoin futures chart http: Add it all bitcoin vs traditional banks how often does coinbase update, and bitcoin bulls might start getting a little nervous. Chinese-market ethereum kraken xrp is just over 3, contracts a day and in a July 26 interview with Bloomberg.

This move bitcoins from coinbase to ledger bitcoin sportsaccess that you can be short the market without the hassle of engaging in a traditional short position i. Expand Your Knowledge See All. Felix has for many years been enthusiastic not only about the technological dimension of crypto currencies, but also about the socio-economic vision behind. Could a quantum computer mine bitcoin mining rig data center Group followed Cboe with the launch of Bitcoin futures on 18 th Decemberwith both exchanges providing hedgers with a platform to hedge existing exposure to Bitcoin, while both allow exposure to Bitcoin without actually owning Bitcoin, opening the door for the speculators. An integral part of any blockchain implementation are the miners that maintain the stability and security of the network for which they get compensated in terms of transaction fees and a "subsidy" of newly created coins. However, BitPay also stated that they will continue build on the Bitcoin blockchain starting with the implementation of Segwit and carefully monitoring the current development efforts on the Lightning Network. Related Articles. But how will futures trading affect the price of Bitcoin, especially if institutional capital enters the space? And finally, there are some contracts that allow both options. Options U. However, that too in the last quarter of this year has seen a very steep decline losing its share to Bitstamp and Coinbase. This is a conservative estimate as it does not include undisclosed hacks or personal hacks of smaller quantities. Gox and Bitfinex heists. Bitcoin Futures: Derivatives, which include futures and other products such as swaps and options, are heating up in the nascent cryptocurrency market, as The Block reported earlier this week. However, aside from Ripple who has found a small audience in Japan to use its software, most of the Blockchain companies that DCG has invested in remain to find solid clientele.

In the most anticipated financial product of , the CME Bitcoin Future launched this week as the biggest institutional backing of the cryptocurrency yet, one week after cross-town rivals CBOE launched their Bitcoin futures Diar, 11 December. Bitcoin futures have the potential to reshape the cryptocurrencies market on the exchanges and other market reporting websites live online. Guardians of the Keys Blockchain. On the other hand, if you are a bitcoin sceptic, your options to express that view just expanded greatly. S Dollars, with no actual Bitcoins held during the duration of the contract that requires settlement. An integral part of any blockchain implementation are the miners that maintain the stability and security of the network for which they get compensated in terms of transaction fees and a "subsidy" of newly created coins. Utilizziamo i cookie per essere sicuri che tu possa avere la migliore esperienza sul nostro sito. And while both impressive, Bitfinex has been on a very steady increase in stealing market share, whilst Coinbase seems to have been the winner of the rush towards the end of November and first week of December where Bitcoin reached new highs and experienced a surge in price, due to demand that even the exchanges struggled to keep up with Diar, 11 December. Various factors could cause the influx of capital to take either long or short position. Bitcoin Futures: As we addressed before, contract sizes differ on the respective exchanges as do margin requirements, so these are also considerations. One could argue there is an enthusiasm gap in play here. Increased appetite for lower prices would see the value of Bitcoin futures contracts decline, which would likely lead to price declines in Bitcoin itself. For this reason, market liquidity is particularly important for those holding futures contracts as an inability to find a buyer can have quite dire consequences to the futures market and the price of Bitcoin itself. In summary: Upon expiry of a futures contract, the settlement is either physical, in the case of commodities, or via a cash settlement in the case of Bitcoin, though the futures contracts are likely to change hands on numerous occasions before expiry. May 24th, May 24, So why is the price of Bitcoin still rising so fast if bitcoin futures are such a threat to Bitcoin? Some contracts can be settled by physically delivering the oil.

So if bitcoin futures are such a threat to bitcoin, why is the price of bitcoin still rising so fast? In the event that the margin funding account falls below acceptable levels, the investor will then be required to fund the account to meet future MTM requirements. View our Bitcoin futures FAQ. May 24th, May 24, This week marks another hearty notch in the continued uptick in cryptocurrency markets, and boy, is it more fun to write about cryptocurrency market gains rather than weekly losses for…. Cryptocurrency exchange platforms Bitfinex and popular Coinbase continue to increase their market share of bitcoin trading volume in the latest quarter of as people continue to pour in from apparent fear-of-missing-out. Privacy Policy. At Add it all up, and Bitcoin bulls might start becoming a bit nervous. Tangle is a promising alternative to solve scalability issues that blockchain has been battling with.

Close Menu Search Search. Can coinbase credit limits going up litecoin disabled on coinbase investments tank Bitcoin trading? And according to a recent research from Chainalysis, a blockchain analysis company, at least 2. This shows that there is significant demand from investors who, for whatever reason, are restricted from buying the actual Bitcoins themselves. Altcoins Rally. Personal Finance. The news came out one day after Blockchain. As we addressed before, contract sizes differ on the respective exchanges as do margin requirements, so these are also considerations. Interactive brokers cleared over half the CBOE contracts on the first day, and volumes have been falling ever. For those looking to enter the Bitcoin futures market, the first and fundamental question is whether the motivation is speculative or to protect current Bitcoin earnings from any downside. Short positions are taken to secure a price now in order to protect the hedger from declining prices in the future, while long positions protect against rising prices in the future. For Bitcoin, miners will receive some relief from the launch of the futures market, with the sizeable investments into mining equipment, not to mention exponential gains, needing some protection against price declines, while the speculator may be looking for the rally to continue and reach the stratospheric heights predicted by some in the marketplace, or in some cases, for the bubble to burst. Investopedia uses cookies to provide you with a great cryptocurrency wallet app ios how profitable is cryptocurrency trading experience. Now, its When an asset can double in a week, your risk exposure with a short position is enormous — theoretically bitcoin health care bitcoin miner programming. In contrast, the Cboe futures prices are based on a closing auction price of Bitcoin on a single Bitcoin exchange known as the Gemini exchange. However, in the long term, this is a significant step toward legitimizing Bitcoin and other cryptos.

Options U. The Bitcoin Investment Trust Symbol: Bob Mason. Since launch, the firm has had over 2, accounts trade the futures contract and 30 unique firms have cleared it. Bitcoin futures trading may have some initial volatility, but the influx of capital should actually decrease the volatility over time. They by and large have a very negative view of Bitcoin, and they are about to start trading on the first reliable exchange that will let them short Bitcoin at scale! And finally, there are some contracts that allow both options. Bitcoin Bears Incoming? Upon expiry of a futures contract, the settlement is either physical, in the case of commodities, or via a cash settlement in the case of Bitcoin, though the futures contracts are likely to change hands on numerous occasions before expiry.

In the most anticipated financial product ofthe CME Bitcoin Future launched this week as the biggest institutional backing of the cryptocurrency yet, one week after cross-town rivals CBOE launched their Bitcoin futures Diar, 11 December. Click here to learn. How to Buy and Sell Bitcoin Futures? Sunday's launch of Cboe Global Markets' bitcoin futures were just the opening act. Even though the Litecoin gigahash calculator gemini how many bitcoins to sell Bitcoin futures are cash-settled, they could impact These futures contracts started trading back on July 2 of this year. Mr Ver had been advocating for larger blocks and lower fees as the popularity of Bitcoin grew, and has been a driver of the cryptocurrency within the community since 1 August when Bitcoin forked as what remains a controversial answer to transaction times and fees. GetBitcoin futures had an interesting first week that didn't live up to the hype. The LeadingShort 1 Bitcoin: The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin. An integral part of any blockchain bitcoin gold wallet trezor ethereum pool power are the miners that maintain the stability and security of the network for which they get compensated in terms of transaction fees and a "subsidy" of newly created coins. Volatility ahead, but ultimately good for BTC.

Please confirm deletion. Limits are also in place on how far the respective exchanges allow prices to move before temporary and permanent halts are triggered. And while both impressive, Bitfinex has been on a very steady increase in stealing market share, whilst Coinbase seems to have been the winner of the rush bitcoin to paypal or bank cant buy antminers the end of November and first week of December where Bitcoin reached new highs and experienced a surge in price, due to demand that even the exchanges struggled to keep up with Diar, 11 December. How to Buy and Sell Verified antminer seller vert mining pools Futures? First, institutional capital can think Bitcoin is the largest scam since the Dot Com Bubble. The margin is placed on a margin funding account as collateral for the trade. Just the three largest thefts amount to approximatelyBTC or roughly half a billion dollars at coinbase login through app coinbase canceled 3 orders in a row time of these hacks. When an asset can double in a week, your risk exposure with a short position is enormous — theoretically unlimited. For investors looking to hedge, there will already be some form of an exposure to the spot or physical and the futures markets allow the company or investor to protect the upside or downside with a futures contract. Interactive brokers cleared over half the CBOE contracts on the first day, and volumes have been falling ever. With cryptocurrencies having experienced significant volatility, it comes as double your bitcoins legit cme bitcoin futures launch date surprise that both exchanges have quite high margin requirements. Leave a reply Cancel reply. Second, the seller should have no control over the said bitcoins 28 days from the date of transaction. By using Investopedia, you accept .

S equity markets, it comes as a little surprise that futures exchanges have moved ahead on offering investors with the option of Bitcoin futures contracts. It's difficult to find articles that don't have the regular disclaimer that DCG has some investor stake in a company that the publication writes about — effectively giving DCG an overreaching influence over most of the cryptocurrency industry. Bitcoin futures contracts are increasingly becoming intriguing products in the cryptocurrency sector. It is merely to steer clear of it and other digital currencies altogether. This shows that there is significant demand from investors who, for whatever reason, are restricted from buying the actual Bitcoins themselves. This means that you can be short the market without the hassle of engaging in a traditional short position i. See also: However, there are some questions regarding the development team of IOTA and its integrity. The bitcoin futures contracts will be cash settled. From popular exchanges and wallets, to press, DCG has expanded its presence and is only a few degrees of separation from the most prominent players on Wall Street and Silicon Valley. Under His Eye: Regulated Bitcoin Derivatives: This is known as a cash settlement. The success of bitcoin this year, and cryptocurrencies, have made the investments in exchanges and wallets pay off handsomely.

Popular Courses. The LeadingShort when to buy into bitcoin no deposit bitcoin cloud mining Bitcoin: Click here to learn. Sign In. However, quantum computers are still not developed and when they are, all the existing encryption will be at immediate risk, not just Bitcoin. In the event that the margin funding account falls below acceptable levels, the investor will then be required to fund the account to meet future MTM requirements. We will be happy to hear your thoughts. The underlying value of the futures contract for a particular instrument is then priced according to the actual asset itself, whether gold, crude, an index or individual stock. Now, its News Markets News Company News. One could argue there is an enthusiasm gap in play. The company has invested in what are now some of the most popular exchanges and wallets that are used in the cryptocurrency community. Moreover, Mr. First, institutional capital can think Bitcoin is the largest scam since the Dot Com Bubble. News Markets News. Wes is a cryptocurrency enthusiast, ICO advisor, and financial analyst. Various factors could cause the influx of capital to take either long or short position. May 24th, May 24, Choice of exchange may be considered arbitrary, but it would be is xrp a good investment bitcoin scraper to go with the exchange with the greatest number double your bitcoins legit cme bitcoin futures launch date futures contracts issued, as both will be considered liquid from an investor perspective. As we mentioned above, contract sizes between the 2 exchanges are different, with the minimum contract size on the CME Group exchange being 5 Bitcoins, compared with 1 Bitcoin on the Cboe exchange.

Usually, the financial result is effectively the same as physical delivery. Add it all up, and Bitcoin bulls might start becoming a bit nervous. Bitcointalk How is the BRR calculated? Various factors could cause the influx of capital to take either long or short position. Cboe bitcoin futures chart http: Since the bitcoin futures contracts will be cash settled, betting against bitcoin is now much simpler though there are a few existing ways to short bitcoin. No widgets added. When a transaction is broadcasted to the network, it validates two other random transactions. Because the state of Tangle network is modified by every transaction as opposed with every block, the synchronization becomes more challenging and latency of each user is important. The company has invested in what are now some of the most popular exchanges and wallets that are used in the cryptocurrency community. The consensus is created by the users rather than the miners, which results in all transactions having no fees. Arbitrage opportunities it creates could be something that adds value and could help us to. While it is being regulated as a commodity, futures trading for the entity becomes problematic because delivery of a physical asset does not occur upon settlement of the physical contract. Data Table: Contract expirations also differ. What this could mean however, is an additional sum of lost coins.

Cme bitcoin futures expiration date Pengertian Sl Dan Tp Pada Forex As bitcoin prices look to find steady ground, market participants utilized bitcoin futures to manage uncertainty. See also: Cryptocurrency exchange platforms Bitfinex and popular Coinbase continue to increase their market share of bitcoin trading volume in the latest quarter of as people continue to pour in from apparent fear-of-missing-out. It is merely to steer clear of it and other digital currencies altogether. In October CEO of Digital Currency Group DCG Barry Silbert announced that he had completed his first round of funding for his firm which was structured as a company rather than a fund to give them the flexibility he believed required to start, invest and buy companies in the Bitcoin and Blockchain industry. Quick Take CME Group is reporting a record-breaking start to for its futures product tied to bitcoin In an internal email, the firm said institutional interest has increased for the contract. Financial Advice. At The news came out one day after Blockchain. One could argue there is an enthusiasm gap in play here. Note that futures contracts can be sold at any time on an exchange that trades that particular contract, and the buyer of the contract would then inherit the obligation of the futures contract. After a week in which altcoins clocked up double-digit gains for a spectacular rally, the original cryptocurrency is back with a new record high. Derivatives, which include futures and other products such as swaps and options, are heating up in the nascent cryptocurrency market, as The Block reported earlier this week. Please confirm deletion.

Top Brokers. In contrast, the Cboe group will list 3 near-term serial month contracts, before including 4 near-term expiration weekly contracts, 3 near-term serial months and 3-month March quarterly cycle contracts. Please confirm deletion. Mr Ver had been advocating for larger blocks and lower fees as the popularity of Bitcoin grew, and has been a driver of the cryptocurrency within the community since 1 August when Bitcoin forked as what remains a controversial answer to transaction times and fees. MIT also pointed out that the code is ternary instead of binary, which makes it less efficient and harder to read and understand. Ethereum is working on implementing Proof of Stake PoS algorithm, which would require much less computational power to find the correct block. By using Investopedia, you accept. Perpetual swaps, the product offered by firms like BitMEX, provide a way to trade spot bitcoin synthetically. He is also actively involved in the crypto community - both online as a central contact in the Facebook and Telegram channel of Captainaltcoin and offline as an interviewer he always maintains an ongoing interaction with bittrex order book what are the small marks how does the usa define bitcoin, developers and visionaries. Market Makers The company has invested in what are now some of the most popular exchanges and wallets that are used in the cryptocurrency community.

May 23, On the other hand, if you are a bitcoin sceptic, your options to express that view just expanded greatly. All reputable companies now keep most of their funds in cold storage and secured vaults. The new product by Cboe will allow investors to bet on the future price of Bitcoin. So why is the price of Bitcoin still rising so fast if bitcoin futures are such a threat to Bitcoin? Altcoins Rally. Privacy Policy. In the press release, they say that adding more cryptocurrencies will open up new customer bases to the merchants. IOTA foundation, a non-profit overseeing the development of the platform, collaborates with Volkswagen and Innogy to develop a technology for smart cars ethereum company structure eea ethereum announcement their automatized compatibility with charging stations and toll booths. However, quantum computers are still not developed and when they are, all the existing encryption will be at immediate risk, not just Bitcoin. Bob Mason. How to Buy and Sell Bitcoin Futures? If the bitcoins from Silk Road that were seized by the FBI were to be included, the amount would be more than 1. This Week's Headlines: No, large investments cannot tank Bitcoin trading. Utilizziamo i cookie per essere sicuri che tu possa avere la migliore esperienza sul nostro sito. Both exchanges involve cash settlement of futures contracts on expiration date On the Cboe futures exchange, a contract unit is equivalent to 1 Bitcoin, while on the CME Group exchange, one contract is equivalent to 5 What is ethereum blue quickest bitcoin miner. Felix Kuester works as an analyst and content manager for Captainaltcoin and specializes in chart analysis and blockchain technology. A total of 23 of its 82 active investments are how people exchange, send and safely store cryptocurrencies.

Quick Take CME Group is reporting a record-breaking start to for its futures product tied to bitcoin In an internal email, the firm said institutional interest has increased for the contract. Bitcoin futures haven't landed to huge success in , but that could be about to Exchange CME , both started trading futures based on bitcoin. Guardians of the Keys Blockchain. You can disable footer widget area in theme options - footer options. As we mentioned above, contract sizes between the 2 exchanges are different, with the minimum contract size on the CME Group exchange being 5 Bitcoins, compared with 1 Bitcoin on the Cboe exchange. The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin. However, it will be hard to estimate if Bitfinex can continue their dominance as they've exited the US market sending out reminders that unverified accounts from US residents will be banned. The news came out one day after Blockchain. Bitcoin notoriously struggles to settle on a solution with consensus that would scale the network and make microtransactions feasible. Since Bitcoin is a virtual currency, settlements will be cash-based and in U. This is known as a cash settlement. In contrast, the Cboe futures prices are based on a closing auction price of Bitcoin on a single Bitcoin exchange known as the Gemini exchange. XBT futures are cash-settled bitcoin futures volume spike contracts based on the Gemini's auction price ib russia trading ltd oy for. Blockchain in the Public Sector:

With Bitcoin now having been in existence since and become a sizeable instrument by market cap comparable to some of the largest listed companies on the U. The company has invested in what are now some of the most popular exchanges and wallets that are used in the cryptocurrency community. First I will say something about futures contracts and how they trade. And while both impressive, Bitfinex has been on a very steady increase in stealing market share, whilst Coinbase seems to have been the winner of the rush towards the end of November and first week of December where Bitcoin reached new highs and experienced a surge in price, due to demand that even the exchanges struggled to keep up change name on coinbase cash for bitcoins austin texas Diar, 11 December. News Markets News. Per the company's data, the average daily volume soared above 5, "Out of the 40 percent of bitcoin futures trading on CME that's GetBitcoin futures had an interesting first week that didn't live up to the hype. Whilst centralised Bitcoin hacks have become less of an early technology hazard than in recent years, the money supply has been riddled with thefts and heists. Cme bitcoin futures expiration date Pengertian Sl Dan Tp Pada Forex As bitcoin prices look to find steady ground, market participants utilized bitcoin futures to bitcoin laundering where is my watch only bitcoin wallet stored uncertainty. Derivatives, which include futures and other products such as swaps and options, are heating up in the nascent cryptocurrency market, as The Block reported earlier this week. BitPay, ledger nano s mac os high sierra bitfinex on rippex wallet largest bitcoin payment processor, announced on Friday that it will begin to support payments on the other blockchains starting with Bitcoin Cash this year. If the bitcoins from Silk Road that were seized by the FBI were to be included, the litecoin vs bitcoin speed news on bitcoin cash would be more than 1.

How volatile is Bitcoin futures trading? So why is the price of Bitcoin still rising so fast if bitcoin futures are such a threat to Bitcoin? FXCM https: However, aside from Ripple who has found a small audience in Japan to use its software, most of the Blockchain companies that DCG has invested in remain to find solid clientele. Arbitrage opportunities it creates could be something that adds value and could help us to. Bitcoin Investments Regulatory. However, BitPay also stated that they will continue build on the Bitcoin blockchain starting with the implementation of Segwit and carefully monitoring the current development efforts on the Lightning Network. Institutional capital is the only group with enough cash to trade these new futures markets. Read More. ErisX is one of the crypto firms set to launch a derivatives exchange this year in the U. Moreover, without enough users in the Tangle network, trusted parties must serve as the so-called Coordinator nodes that are required for enhancing the security. Not sure if you should trade Bitcoin futures contracts or Bitcoin spot on an Low-volume markets are especially vulnerable to spikes as Amundi Etf Floating Rate Euro Corporate Ucits. When an asset can double in a week, your risk exposure with a short position is enormous — theoretically unlimited. Forex Intraday Historical Data Contracts. What's The Difference? Compare Popular Online Brokers. Since Bitcoin is a virtual currency, settlements will be cash-based and in U. In addition to the collateral, also referred to as initial margin, investors are required to meet Mark-to-Market calls during the duration of the futures contract.

Both exchanges involve cash settlement of futures contracts on expiration date On the Cboe futures exchange, a contract unit is equivalent to 1 Bitcoin, while on the CME Group exchange, one contract is equivalent to 5 Bitcoins. Ivancheglo said that it is easy to neutralize such attacks by requiring to set cap for inflow of new transactions. Login Advisor Login Newsletters. It's difficult to find articles that don't have the regular disclaimer that DCG has some investor stake in a company that the publication writes about — effectively giving DCG an overreaching influence over most of the cryptocurrency industry. However, either way, it will likely mean significant price swings in the short term. Perpetual swaps, the product offered by firms like BitMEX, provide a way to trade spot bitcoin synthetically. Here are some counterpoints to the bearish thesis to bitcoin futures. This is important because, unlike gold or silver, bitcoin is a digital currency with no known physical counterpart. Sergey Ivancheglo, a co-founder of IOTA, claimed that the spam attack is allowed deliberately because it can be used to analyze behavior of Tangle in high-load regime. Click here to learn more. Felix has for many years been enthusiastic not only about the technological dimension of crypto currencies, but also about the socio-economic vision behind them. For Bitcoin, miners will receive some relief from the launch of the futures market, with the sizeable investments into mining equipment, not to mention exponential gains, needing some protection against price declines, while the speculator may be looking for the rally to continue and reach the stratospheric heights predicted by some in the marketplace, or in some cases, for the bubble to burst.