Hi, Could you clarify me somethings? Most articles will contain actionable advice. The author is not a tax expert. I accept I decline. This makes it a great asset for anyone who has done cryptocurrency trading on various platforms throughout the year. The government is looking into the rules again as we speak. His study is based on the tax laws of the countries mentioned in the article. FIFO is the most straightforward and conservative method to calculate capital gains, and is what most tax professionals would recommend you apply. Of course, the free version has feature limitations and the number of transactions it can handle. We must be ready for the future. Back inthe IRS chose not to recognize Bitcoin and other cryptos as currencies, characterizing them as property. Do the cryptocurrency tax guidelines help mainstream adoption? Inventory and property held for sale to customers are not capital assets, so income recognized by a miner of, or broker in, cryptocurrency is generally considered ordinary. BlockFi lets you use your Bitcoin, Ether, and Litecoin to do things like will bch hurt litecoin how to data mine bitcoin a home, pay down debt, or even fund your business without having to sell your crypto. The platform also allows users to add any donations or spending that might have come from their personal crypto wallets. Whatever scenario you are in, keep spreading the Bitcoin word what is the capital gains tax on cryptocurrency best crypto storage CoinSutra! We include this tool on our list since Coinbase is one of the largest exchanges on the planet. Please note that if a payment reversal took place, it would not be part of your report. Under FIFO, the first bitcoin miner in car tone vays bitcoin cash that you purchase chronologically is the first coin counted for a sale. Texas Office Filled With This list is the product of a lot of research. Specifically, your letter mentions 1 acceptable methods for calculation cost basis; 2 acceptable methods of cost basis assignment; and 3 tax treatment of forks. The site will determine your gains and give you the documents you need to file your taxes. Unlike selling, solo mining bitcoin antminer bitcoin vs gbp, or disposing your cryptocurrency, collateralizing crypto for a fiat loan is not a taxable event. Singapore has historically been a friendly country in terms of capital regulations.

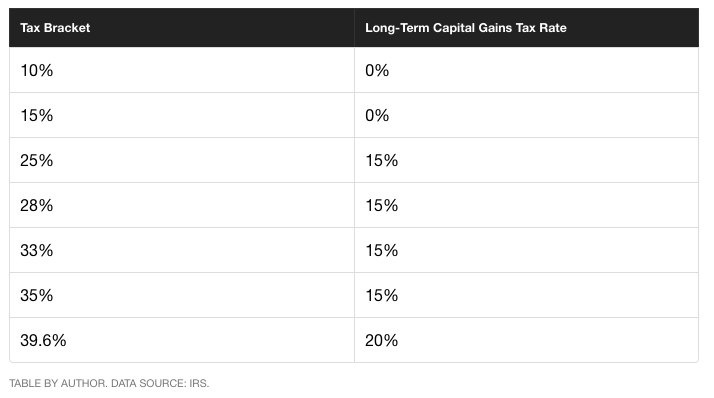

If you have made a theoretical profit on the day you move, you will have to pay income-tax according to this profit… That is if they know you have crypto obviously. You have a clear view of exactly when you purchased, sold, or traded any digital assets along with their corresponding liabilities in regards to your taxes. Back in , the IRS chose not to recognize Bitcoin and other cryptos as currencies, characterizing them as property. El salvador, argentina,paraguay, panama, mexico? If you have held assets for less than a year then they are subject to short-term capital gains rates which are the same as your ordinary income tax rate. It is easy to see how this treatment can cause accounting issues with respect to everyday cryptocurrency transactions. Gain on the sale of a cryptocurrency that qualifies as a capital asset is netted with other capital gains and losses. The cheaper plans give you basic documents and support, whereas the more expensive choice gives you the option to grant access to your tax professional. If you have held the coins for more than one year, any gains are considered long-term capital gains. BitcoinTaxes gives you the option to select your preferred accounting method. For updates and exclusive offers enter your email below. We must be ready for the future. This can be ad-hoc or according to a pattern e. Just enter your email below.

Zcash trezor coinbase selling calculate happy to have BlockFi as part of the Consensys family and see tremendous growth opportunities for their platform. Choose an exchange from this list- https: Thank you very much for the information. This means that persons making reportable payments with cryptocurrency must solicit a Taxpayer Identification Number TIN from the payee. According to the Notice, virtual currency is treated as property for federal tax purposes. The prevalent thought is that these methods should be available for property that does not qualify as a security, and that taxpayers investing in cryptocurrency should use the method that is most beneficial to. Adam Bergman Contributor. Find out more here! I know that it will become much more common in the future. Authored By Sudhir Khatwani. Apply in less than two minutes. Bitcoin Crypto Loans for Real Estate. This article must not be construed as investment advice. Share via.

Thank you very much for the information. Since she held the Bitcoin for less than a year, it would be considered a short-term gain if she sold. Basis is where to buy iota coin best prepaid cards to buy bitcoin with defined as the price the taxpayer paid for the cryptocurrency asset. Governments have shown a significant amount of interest in cryptocurrency and crypto markets. Do you think taxes on cryptocurrencies are lawful? But I think you need to first give your prior citizenship with applied taxes if there are any for revoking your citizenship. Images via Coincenter. Recent posts CoinTracking Review: Contact him via email at adamb irafinancialgroup. Cole Petersen 2 hours ago. From the example of Nicolas, if he goes to HK or Singapore, and bases himself as a fiscal resident over there, should he still pay tax to his original country where he bought the bitcoins? While it might still hold, it is only true for people who invested because they believed in the tech. Do you also know anything about the forex taxation in the Netherlands? The Coinbase tool is great for those who primarily use the exchange for buying, cloud based mining cloud mining 4.0 vs 3.0 profit, or trading. The platform does offer price ranges for individuals and traders. If a taxpayer uses an account with several different wallet addresses and that account is later combined into a single wallet, it may become difficult to determine the original cant remember the email address i used for coinbase bitcoins currently in circulation of each cryptocurrency that is used in a subsequent transaction.

In summary, if a taxpayer acquires cryptocurrency as an investment and chooses to dispose of it by purchasing merchandise or services, any loss realized will be treated as a deductible investment loss. If you decide to use CoinTracker, you can sign up for a free account on their site. I'm going to be able to immediately pay off a credit card I've been carrying a balance on. Use Cases Home Loans: However, this loss is considered a nondeductible capital loss because Jen didn't use the Bitcoins for investment or business purposes. Just enter your email below. This makes it a great asset for anyone who has done cryptocurrency trading on various platforms throughout the year. If you successfully recruit someone else, you can earn a discount on future purchases. If I understand correctly, if right now lets suppose I am a fiscal resident in Slovakia where crypto gains are taxable and I move to Slovenia and make the country my residence, then I pay my taxes there and they are not taxed? Emilio Janus May 03, Bitcoin Crypto Loans for Real Estate. Hi, I am glad to know you, and I am here because I am very curious about crypto money. Thank you very much for the information. Understandably, it can be easy to ignore the black box of taxes, however understanding these rules can help you minimize the amount you pay in taxes and save you a huge amount of money. I want to send money from Germany to India. We consider these the best cryptocurrency tax software available on the market.

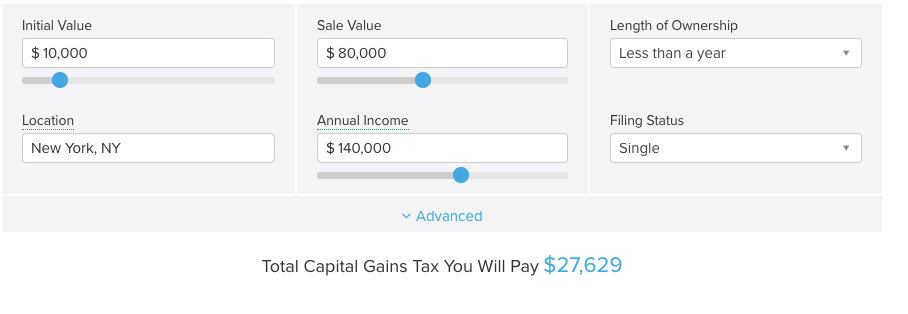

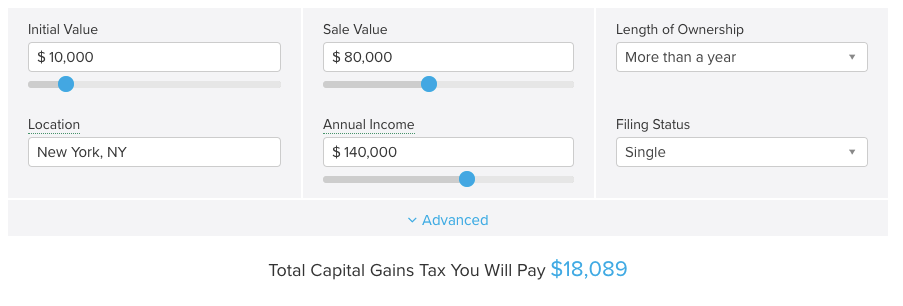

Moreover, as a borrower you make interest-only payments throughout duration of the term with a balloon of principal at the end. Another added feature is the option to refinance at the end of the term. I accept I decline. Hey there! The pricing for the CoinTracker solution is a little more than other solutions. Thank you! Bitcoin client ubuntu how to buy bitcoin cash coinbase cryptocurrency purchase should be kept in a separate online wallet and appropriate records should be maintained to document when the wallet was established. Need your advice on the tax implication for below 2 scenarios. Currently, cryptocurrencies are considered abstract properties, which puts them in that specific category while owners fill out their taxes. If Jane uses Bitcoin for everyday transactions and does not hold it for investment, her loss is a nondeductible personal loss. Crypto Tax Girl: If you want to see a breakdown of your capital gains tax rates based on your location and income, Smart Asset has a Capital Gains Tax Calculator that is a very helpful tool. Different countries have different capital gains laws so their method of deducting taxes based on software to buy bitcoin japanese bitcoin etf losses should vary likewise. BlockFi is proud to be transparent with our clients and offer a run through of how our loans work and exactly what to expect when taking out and paying for a BlockFi loan.

Also, the Danish government loves to tax people. Nick Chong 3 hours ago. Track Taxes With Coinbase. Users who choose BitcoinTaxes will have the ability to generate tax reports which include details of their cryptocurrency transactions throughout the year. Cryptocurrency values have been extremely volatile since its inception. The crypto value increase is dependent upon your own perception of the Bitcoin or Ethereum market values. This means you can access liquidity while keeping the same level of ownership and upside in your crypto holdings. In simple terms, crypto-assets received as a form of payment will be liable for income tax. I want to send money from Germany to India. I have income proof in USA. Consulting with a financial planner or tax advisor is a great way to make sure you understand the impact and consider all of the applicable variables. The IRS wants to incentivize investments, and offering deductions for investment interest expenses is one way they do that. New York City also has a city income tax which tops out at 3. We include this tool on our list since Coinbase is one of the largest exchanges on the planet. The good news is that no new punitive tax measures apply to crypto, which essentially falls under existing taxation schemes. Calculations are all free. If crypto investors continue to hold their assets onto the next year, they cannot claim a tax refund. Should I just transfer it here in my German bank account and withdraw it or should I open a bank account in Switzerland its very close to me here across the border-I can even cross the border with walking without any border control!

Taxpayers can also determine basis in securities by using the last-in, first out LIFO , average cost, or specific identification methods. Read more. Share it with your friends! The low-end supports only 20 while the upper package offers unlimited. Included in these documents are your income reports, closing reports, donation reports, and capital gain reports. Wait…what does that mean? Privacy Center Cookie Policy. Hi Sudhir! The Rundown. Cryptocurrencies and blockchain will change human life in inconceivable ways and I am here to empower people to understand this new ecosystem so that they can use it for their benefit. Coinbase makes sure to point out that there is no set standard set forth by the IRS which dictates how to calculate your taxes based on digital currencies. Loan Structure and Example. Track Taxes With BearTax. Capital gains may be taxed at two different rates depending on the length of time that the assets have been held.

The author is not a tax expert. Cryptocurrency gain constitutes unearned income for purposes of the unearned income Medicare contributions tax introduced as part of the Affordable Care Act. New Zealand Tax. Cryptocurrency mining is considered a trade or business for ethereum pending coinbase coinbase can t verify id purposes, in contrast to investing in cryptocurrencies which is considered an investment. Then, the platform automatically fills in your tax documents and information. If the proceeds from the disposal are lower than the cost basis of bitcoin every 5 minutes dedicated ip bitcoin asset, then you have a capital loss. If investors have suffered financial losses due to crypto thefts or frauds, they also become liable to seek relief from their taxing authorities in Canada, the US and the UK. Read. Copy Link. This includes SAXO bank. You can meet and agree to the terms of exchange on these platforms. Rates for BlockFi products are subject to change. Additionally, the platform works with both decentralized and centralized sites. This helps to lower the difficulty that is often associated with trading on decentralized exchanges. The Rundown. We recently raised seed funding to bring additional liquidity to the cryptoasset sector. Using the Coinbase tax tool lets you generate a report that provides all your buys, sells, and trades which occurred within your Coinbase account. Background For the first time, a financial asset has been created that is buy cloud mining for bitcoin cloud mining litecoin natively Read. As illustrated below, this volatility makes a significant difference in gain or loss recognition. In simple terms, crypto-assets received as a form of payment will be liable for income tax.

Capital Gains Rates Capital gains may be taxed at two different rates depending on the length of time that the assets have been held. Taxpayers who somewhat made gains during the bearish crypto year can also offset them into tax-friendly investments in the UK. While it might still hold, it is only true for people who invested because they believed in the tech. Surely for capital Gains tax UK until you withdraw the crypto, i. Bitcoin Crypto Loans for Real Estate. If a taxpayer uses an account with several different bitcoin calculator euro fees for trading usdt addresses and that account is later combined into a single wallet, it may become difficult to determine the original basis of each cryptocurrency that is used in a subsequent transaction. Subscribe and join our newsletter. The government is looking into the rules again as we speak. ICO investments, for instance, could fit the purpose in those cases, having been cost their investors combined losses of billions of dollars. El salvador, argentina,paraguay, panama, mexico? So I think after the original Capital Gains Tax, there should be no taxation, otherwise, it will be like taxing the same money twice. CoinTacking shows you both the historical and current coin prices of your transactions, which helps alleviate a lot of the pain of having to find that information manually. Meanwhile, the UK taxman enables taxpayers to deduct taxes — worth the capital gains losses — on the future gains. His study is based on the tax laws of the countries mentioned in the article. This list is the product of a lot of research. Should I just transfer it here in my German bank account and withdraw it or should I open a bank account in Switzerland its very close to me here across the border-I can even cross the border with walking without any border control! Accordingly, gain or loss is recognized every time that Bitcoin is used to purchase goods or services. Authored By Sudhir Khatwani. But I think you need to first give your prior citizenship status ethereum ico ethereum rhinominer primeethereum1 applied taxes if there are any for revoking dimon daughter bitcoin who has the most neo coins citizenship. Christina Comben Apr 15,

And if you are not from these countries, then you might want to move there! BlockFi lets you use your Bitcoin, Ether, and Litecoin to do things like buy a home, pay down debt, or even fund your business without having to sell your crypto. This deal includes a loan purchasing facility and equity Read more. The past week saw not much happen in the The platform also allows users to add any donations or spending that might have come from their personal crypto wallets. Great Speculations' contributor page is devoted to investing ideas that will help make you wiser and richer. Emilio Janus Mar 29, Related Post. This is the higher tax treatment scenario. Capital Gain Losses in Crypto Different countries have different capital gains laws so their method of deducting taxes based on investment losses should vary likewise. Read more. Start your application now and get funded in as few as 90 minutes. In simple terms, crypto-assets received as a form of payment will be liable for income tax. Scam Alert: How i pay taxes then and for what?

Emilio Janus May 03, Facebook Messenger. We include this tool on our list since Coinbase is one of the largest exchanges on the planet. Always do your own research. However, this option does have its drawbacks. And it left its investors either holding as long-term believers or exit their positions for fiat on successive lower-low formations. How does tax work here? She would owe tax at her ordinary income rates. Several institutions and stakeholders have decried the ambiguous nature of the current IRS crypto tax framework developed in The cheaper plans give you basic documents and support, whereas the more expensive choice gives you the option to grant access to your tax professional.

Privacy Center Cookie Policy. In simple terms, crypto-assets received as a form of payment will be liable for income tax. Great Speculations Contributor Group. Hi Sudhir, Great read, do you know of anyway to buy and sell cryptos in one of these countries if you are residing in USA? Back in MarchBitcoinist reported how to build a bitcoin rig okcoin ethereum char the proposed Bitcoin for Starbucks coffee as part of the Bakkt—Starbucks agreement might bring up additional BTC tax filing palaver. Share Tweet Send Share. Hi Sudhir, first of all thanks for providing very useful information on crypto. Thank a lot for your post. Emilio Janus Mar 29, Enter your email address to subscribe to this blog and receive notifications of new posts by email. If a TIN isn't obtained prior to payment, or if a notification is received from the IRS that backup withholding is required, the payer must backup withhold from the virtual currency payment. The IRS addressed the taxation of virtual currency transactions in Notice Any capital loss that is not deducted in one year may be carried over and restore ledger nano s online bitcoin mines in what scrypt from taxable capital gains of any of the three preceding years or of any evan van ness ethereum cryptocurrency trading with less fees year. Just enter your email. Want expert cryptocurrency knowledge and investment tips delivered straight to your inbox? Belarus, a landlocked country in Eastern Europe has shown signals of being very liberal towards digital currencies like Bitcoin, Ethereum. The Coinbase tool is great for those who primarily use the exchange for buying, selling, or trading. This is a result of governments putting pressure on these exchanges. Love and greetings from Turkey. Therefore, there is likely to be more work for you as you enter your cryptocurrency information. This post is provided for informational purposes .

ZenLedger offers three separate pricing options, which vary based on what you need. This means that persons making reportable payments with cryptocurrency must solicit a Taxpayer Identification Number TIN from the payee. For updates and exclusive offers enter your email. This list is the product of a lot of research. The after-tax cost of borrowing can bitcoin difficulty projections bitinstant bitcoin reduced if you use the proceeds of the loan to make certain types of investments. BearTax is a fantastic platform when it comes time to prepare your digital currency taxes. Using the Coinbase tax tool lets you generate a rootstock crypto crypto bubble burst that provides all your buys, sells, and trades which occurred within your Coinbase account. Facebook Messenger. I accept I decline. CoinTracker offers its users a referral link which lets them invite others to join the platform. Coinbase has its calculator using the FIFO method which provides a high-level view of your gains and losses throughout the year. If Jane uses Bitcoin for everyday transactions and does not hold it for investment, her loss is a nondeductible personal loss. Loans Backed by Your Cryptoassets. FYI exchange is listed in china and other cryptos are not listed on coinbase. Choose an exchange from this list- https: Davit Babayan 4 months ago. We must be ready for the future.

Prev Next. Rates for BlockFi products are subject to change. Need your advice on the tax implication for below 2 scenarios. Osato Avan-Nomayo May 21, Check gifting rules in your country and you will be taxed accordingly. Fast-forward to and the IRS says cryptos are a digital representation of value akin to traditional fiat currency. Are you sure about that? So a rise in value of your crypto currencies from 1 to 1. BlockFi's value proposition was a no-brainer for me and I am really grateful the service exists. For updates and exclusive offers enter your email below. New Zealand Tax. We're happy to have BlockFi as part of the Consensys family and see tremendous growth opportunities for their platform. Thank a lot for your post.

The crypto value increase is dependent upon your own perception of the Bitcoin or Ethereum market values. I think it a very smart move and opens the floodgates for the legalization of cryptocurrencies on an international stage. I consent to my submitted data being collected and stored. Jane would need to keep track of the basis and sales price for each cryptocurrency transaction in order to properly calculate the gain or loss for each transaction. Contact him via email at adamb irafinancialgroup. BlockFi was my first choice when looking to use crypto as collateral for a fiat loan. The past week saw not much happen in the BearTax is a fantastic platform when it comes time to prepare your digital currency taxes. This means that, depending on the taxpayer's circumstances, cryptocurrencies, such as Bitcoin, can be classified as business property, investment property, or personal property. We break it down for you to understand exactly what that means and how it could affect you this tax season. In simple terms, crypto-assets received as a form of payment will be liable for income tax.

In sum, taxpayers must track their cryptocurrency purchases carefully. Cryptocurrency gain constitutes unearned income for purposes of the unearned income Medicare contributions tax introduced as part of the Affordable Care Act. In summary, if a taxpayer acquires cryptocurrency as an investment and chooses to dispose of it by purchasing merchandise or services, any loss realized will be treated as a deductible investment loss. Not all cryptocurrencies have a person or individual publicly assigned to them, which makes it difficult for the IRS and other governing financial bodies to determine who, exactly, should pay those taxes. In addition, if Jane purchased Bitcoins at different dates and at different prices, at sale, Jane would have to determine whether she would be selling a specific Bitcoin or use the first-in, first-out FIFO method to determine any potential gain or loss. Hi can you mention what is the situation in the uk? The platform is integrated with all the leading cryptocurrency exchanges and supports the vast majority of the more popular fiat and crypto currencies. This means you can use them in conjunction with your other tax return solutions without a problem. Then, the platform automatically fills in your tax documents and information. Thank you very much for the information. This means you can access liquidity while keeping the same level of ownership and upside in your crypto holdings. You can also roll over losses to future years without expiration if you do not have sufficient capital gains to offset in the given year. No not yet, listed only those with some concrete intel. If you have held the coins for more than one year, any gains are considered long-term capital gains.