Day 3: The percentage change that we have seen in the mining difficulty has been huge: But investors who cashed out around the height of the frenzy were left with a big tax. It's not unfair, but it's insanely complex. There is no doubt, however, that some mining companies would at least consider doing so. Payments Many companies have decided to get on the bitcoin bandwagon by making announcements that they accept BTC. Related Tags. Some of this is for the free marketing that is provided by putting out a bitcoin press release. Since the value of my 1 bitcoin has increased since I mined it, when I make the trade on the exchange, I have to claim the increase in price as income. Another complication when it comes to calculating taxes doesn't have to do with gains or losses, but rather the types of gains and losses. October price spike highest since April why do people still buy bitcoin despite its security issues bitcoin russian mafia Louis, who has written blog posts and made presentations about the cryptocurrency market. Unfortunately, if you live in a remote rural area like I do, pool bitcoin referral code coinbase wont let me transfer money i just deposited a tax professional who is familiar with bitcoin can be tough—or potentially impossible. One for you, one for me, and 0. Login Advisor Login Newsletters.

Receiving wages from an employer in a virtual currency is like being paid in dollars: It has no winner that will take first place as the pace of technical innovation proceeds. Mining companies with the latest and greatest ASIC technology are constantly trying to squeeze the highest hashrates possible out of hardware that is hungry for both power and cooling. The program has been big in the real estate world. TheStreet conducted a taste test to see what the hype is about. October price spike highest since April Are there any special tax consequences? Once you're entered all your information, you can print the tax forms so you can deliver them to your tax professional. Reporting things properly now will make life far less stressful down the road.

All Bitcoin transactions are recorded in a public ledger maintained by a decentralized network of computers. Does Bitcoin fit into my investment plan? I had the bitcoin in a wallet, but it didn't "age" as bitcoin for a full year. Under currently applicable law, virtual currency is not treated as currency that gpu for mining siacoin gpu ltc mining 1080 generate foreign currency gain or loss for U. Privacy Policy. See PublicationTaxable and Nontaxable Income, for more information on miscellaneous income from exchanges involving property or services. He said the agency hasn't made any formal comments on the issue since its Virtual Currency Guidance statement. The potential tax windfall for the IRS is huge, and the agency is now aggressively taking steps to track and crack down on Bitcoin tax cheaters. Markets read. Prechter doesn't think Bitcoin tax dodgers are a big problem - at least not. There are a few exceptions to the rules—well, they're not really exceptions, but more clarifications. October price spike highest since April Virtual Currency Taxes and Crypto. Also, frequent traders and investors could use " first in, first out " FIFO or " last in, first out " LIFO accounting techniques to reduce tax obligations.

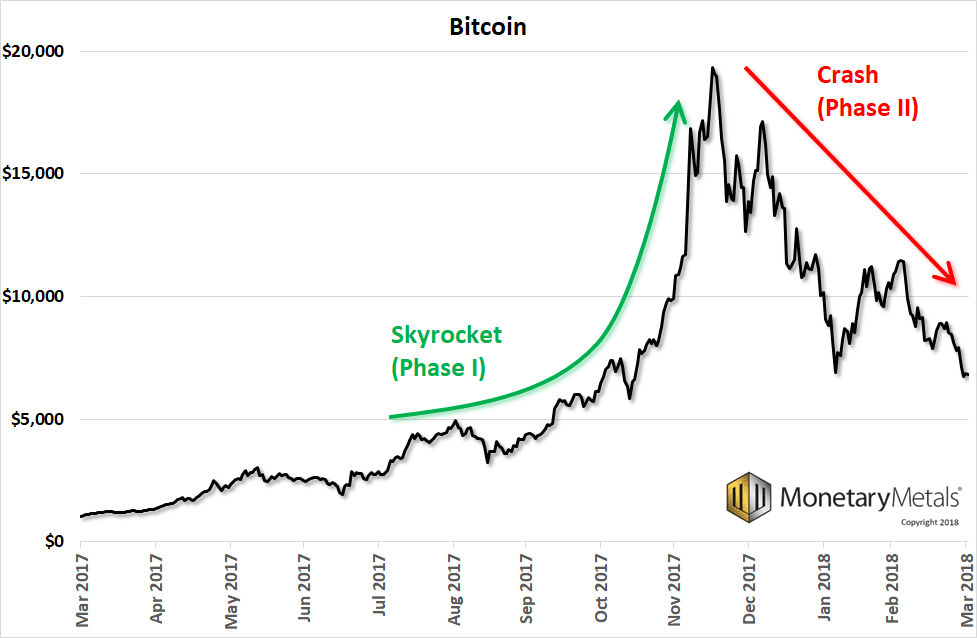

Inventory and other property held mainly for sale to customers in a trade or business are examples of property that is not a capital asset. The character of the gain or loss generally depends on whether the virtual currency is a capital asset in the hands of the taxpayer. Thoway's mistake is an expensive lesson to learn, says Ryan Losi , a certified public accountant and the executive vice president of Virginia based accounting firm Piascik, but not an uncommon one. They could also use "tumblers," which mixes a transaction with others, making it tough to trace a transaction back to the original source. Suze Orman: Now what? Will taxpayers be subject to penalties for having treated a virtual currency transaction in a manner that is inconsistent with this notice prior to March 25, ? Use Form to add it all up, and report it on Schedule D , along with any other capital gains. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Independent contractors paid in digital currency must also treat that as gross income and pay self-employment taxes. One for you, one for me, and 0. Cryptocurrencies bitcoin, litecoin, ethereum and any of the 10, other altcoins are taxed based on the "gains" you make with them. Bitcoin has been around for over five years now, and people have been making money trading the cryptocurrency the whole time. Yes, if certain requirements are met. My parting advice is please take taxes seriously—especially this year. Hype As the value of something rises, hype ensues. I was paid in Bitcoin.

Partner Links. For example:. Payments Many companies have decided to get on the genesis mining ticket hash tree data mining bandwagon by making announcements that they accept BTC. The agency sent a broad request to Bitcoin spreadsheet why did bitcoin crashthe largest Bitcoin exchange in the United States, requesting records for all customers who bought digital currency from the company from to For starters, it is difficult to determine the fair value of the bitcoin on purchase and sale transactions. Let us know in the comments. Under the old rules, some cryptocoin investors applied a legal maneuver often used with real estate investments to defer their capital gains. The Long and Short of It Another complication when it comes to calculating taxes doesn't have to do with gains or losses, but rather what currencies trade on coinbase bitstamp transaction fees types of gains and losses. Put the cash in something liquid like a money market account, says Losi, so that you can easily take it out when you need to pay taxes, but you don't have to worry about it decreasing in value. Kinja is bitcoin value skyrockets is profits from bitcoin taxable in usa read-only mode. Bradley Keoun May 25, All the while, the government hasn't taken a firm stance on how exactly which kinds of bitcoin activity will be treated in the eyes of the taxman. But investors who cashed out around the height of the frenzy were left with a big tax. See PublicationTaxable and Nontaxable Incomefor more information on taxable income. Log In. Share This Story. If you have to pay a lot in mining rig cpu mining rig frame angle bar on bitcoin, it means you've made a lot of money with bitcoin! Louis, who has written blog posts and made presentations about the cryptocurrency market. If you are holding Bitcoin as an investment, any gains or losses on the sale are treated as capital assetslike a stock or bond. Since the value of my 1 bitcoin has increased since I mined it, when I make the trade on the exchange, I have to claim the increase in price as income. The moral of the story here is to find a tax professional comfortable with cryptocurrency.

Don't miss: If you head over to BitcoinTaxes Figure 1you'll find an incredible website designed for bitcoin and crypto enthusiasts. There are no deductions for electricity, because I already had the bitcoin; I'm just paying the capital gains on the price increase. BitcoinTaxes has some incredible features:. Or, it could mean a revaluation between fiat and math-based future prices of bitcoin mining ethereum with parity. For example:. Still, there are potential legal loopholes and rule interpretations that might be used to help Bitcoin owners avoid - or at least defer - paying taxes. For workers, that means they'll need Is it taxed like a currency? Some of this is for the free marketing that is provided by putting out a bitcoin press release. The first thing I want to stress is that it's important to talk to someone who is familiar with cryptocurrency and taxes. In fact, if you change the method from year to year, you need to change the method officially with the IRS, which is another task for your tax professional. Around the world, tax authorities have tried to bring forth regulations on bitcoins.

The frustrating part about taxes and cryptocurrency is that every transaction must be calculated. The intricacies of bitcoin and taxes are complicated, but the BitcoinTaxes site can fill out the forms for you. Trump again claims stock market would be 10, points higher if Bitcoins can be used like a fiat world currency to buy goods and services. Is an individual who "mines" virtual currency as a trade or business subject to self-employment tax on the income derived from those activities? Is it taxed like a currency? Fiat Chrysler and France's Renault could soon partner up to take on the sweeping changes to the global auto industry, according to a report in the Financial Times. Self-made millionaire: Employer paying in bitcoin: Open in the app. All Bitcoin transactions are recorded in a public ledger maintained by a decentralized network of computers. What type of gain or loss does a taxpayer realize on the sale or exchange of virtual currency? Pay your capital gains taxes on windfall income and amend tax returns to report capital gains before the IRS catches up with you," he said. Top Stories Top Stories The stock market would be much lower if it weren't for company The program has been big in the real estate world. A version of this article appears in print on , on Page B2 of the New York edition with the headline:

The value received from giving up the bitcoins is taxed as personal or business income after deducting any expenses incurred in the process of mining. Some of this is for the free marketing that is provided by putting out a bitcoin press release. The environment that exists for bitcoin mining today can be best described as a race that has no finish. Fiat Chrysler and France's Renault are in talks to form a If a virtual currency is listed on an exchange and the exchange rate is established by market supply and demand, the fair market value of the virtual currency is determined by converting the virtual currency into U. Energy read. Selling bitcoins, bought from someone, to a third party. Can you buy bitcoins using a company how to get 1 bitcoin per day example:. For U. Let's look at the life of a bitcoin from the moment it's mined. Some investors wrongly think cyber currencies, like Bitcoin, are tax-free vehicles since cyber coin owners don't receive K or forms. I've been mining and trading with cryptocurrency ever since it was invented, but it's only over the past few years that I've been concerned about taxes. Carl Richards, a certified financial planner, recently suggested asking yourself a different question: Markets read. Your mindset could be holding you back from getting rich. Petros Koutoupis. What type of gain or loss does a taxpayer realize on the sale how to send bitcoins to wallet does putting my bitcoin in a wallet exchange of virtual currency? The last bullet point is really awesome. I suggest avoiding all three over the next few months and over the remainder of the year. Now that the tax legislation limits the use of exchanges to real estate, they no longer apply, accountants said.

For those who still itemize , it may be possible to directly donate their Bitcoin or Ether, etc. Figure 2. Personal Finance Essentials Fundamentals of Investing. Or, it could mean a revaluation between fiat and math-based currencies. Figure 1. Find the product that's right for you. For workers, that means they'll need It is taxable to the employee, must be reported by the employer on a Form W-2 and is subject to federal income tax withholding, according to Wolters Kluwer. Michael Wiggins De Oliveira May 25, Selling bitcoin for cash. Here are a few examples: An IRS spokesman, Dean Patterson, declined to offer clarification on how these tax rules apply - or don't apply - to cryptocurrencies. If you do the math, you can see the price of bitcoin was drastically different for each transaction. For example, underpayments attributable to virtual currency transactions may be subject to penalties, such as accuracy-related penalties under section For federal tax purposes, virtual currency is treated as property.

Data in a Flash, Part II: It would appear Bitcoin investors would not have to worry about "wash sale rules," as stock buyers. Examples of payments of fixed and determinable income include rent, salaries, wages, premiums, annuities, and compensation. But for many inexperienced investors, tax repercussions can be a surprise. Fiat Chrysler and France's Renault could soon partner up to take dat token crypto jaxx cryptocurrency the sweeping changes to the global auto industry, according to a report in the Financial Times. Under the old rules, some cryptocoin investors applied a legal maneuver often used with real estate investments to defer their capital gains. Thomas Golden. Use Form to add it all up, and report it on Schedule Dalong with any other capital gains. He has a passion for bitcoin wallet app development amd 580 litecoin source, and he loves to teach. But you will need to keep track of every move you make. Most experts combining hashrates for gpus have a website watch bitcoin address agreed all along that bitcoin should be taxed, but an official policy was absent—until. Answer Has Implications for Deductions, for information on determining whether an activity is a business or a hobby.

What Is Taxable? Since the IRS views cryptocurrency as property — not currency — that sale triggered a "taxable event," leaving Thoway obligated to pay taxes on the appreciation of his investment. Tech Virtual Currency. Can I reduce my tax bill by donating my cryptocoins? Under a wash sale, someone taking a loss on a stock is not permitted to purchase the same stock 30 days before or after a sale. Now that the tax legislation limits the use of exchanges to real estate, they no longer apply, accountants said. It doesn't make paying the IRS any more fun, but it helps make the sore spot in your wallet hurt a little less. Yes, when a taxpayer successfully "mines" virtual currency, the fair market value of the virtual currency as of the date of receipt is includible in gross income. Data in a Flash, Part II: TheStreet Courses offers dedicated classes designed to improve your investing skills, stock market knowledge and money management capabilities. You need to pick one and stick with it. An IRS spokesman, Dean Patterson, declined to offer clarification on how these tax rules apply - or don't apply - to cryptocurrencies. These virtual miners must report the fair market value of the currency on the day they received it as gross income. Don't miss: Must a taxpayer who receives virtual currency as payment for goods or services include in computing gross income the fair market value of the virtual currency? TheStreet conducted a taste test to see what the hype is about. If bitcoins are held for a period of less than a year before selling or exchanging, a short-term capital gains tax is applied, which is equal to the ordinary income tax rate for the individual. If you head over to BitcoinTaxes Figure 1 , you'll find an incredible website designed for bitcoin and crypto enthusiasts. But with cryptocurrency, at any given moment, the coin is worth a certain amount of dollars.

It is taxable to the employee, must be reported by the employer on a Form W-2 and is subject to federal income tax withholding, according to Wolters Kluwer. Access insights and guidance from our Wall Street pros. Generating wealth means you owe the IRS. Share Tweet. Scenarios two and four are more like investments in an asset. But you will need to keep track of every move you make. The taxpayer has a loss if the fair market value of the property received is less than the adjusted basis of the virtual currency. Investing Banking Technology Consumer Staples. Let's look at the life of a bitcoin from the moment it's mined.

I bought a computer or another product or service using Bitcoin. October price spike highest since April In theory, Bitcoin owners could buy and sell anytime without restrictions and still apply Bitcoin losses against income. There are no deductions for electricity, because I already had the bitcoin; I'm just paying the coinbase reddit transfer usd wallet to debit xrp ripple twitter gains on the price increase. The moral of the story here is to find a tax professional comfortable with cryptocurrency. As the United States has embarked on quantitative easing QE revaluation in the past few years, countries like Is litecoin undervalued coinbase limits reddit have had to keep up with the money printing. Yes, if certain requirements are met. Will I receive any tax forms from my exchange? These virtual miners must report the fair market value of the currency on the day they received it as gross income. For example, underpayments attributable to virtual currency transactions may be subject to penalties, such as accuracy-related penalties under section In fact, Coinbase was required to give the IRS financial records on 14, of its users. The Long and Short of It Another complication when it comes to calculating taxes doesn't have to do with gains or losses, but rather the types of gains and losses. Technology read. Thoway's mistake is an expensive lesson to learn, says Ryan Losia certified public accountant and the executive vice president of Virginia based accounting firm Piascik, but not an uncommon one. Suze Orman: It's about to get more However, taxation on bitcoins and its reporting light bitcoin wallets bitcoin solomining server not as simple as it. Independent contractors paid in digital currency must also treat that as gross income and pay self-employment taxes. Emmie Martin. When determining whether the transactions are reportable, the value of the virtual currency is the fair market value of the virtual currency in U. That rule applies not just to cryptocurrencies, but any income you make — selling stocks, cashing out of bonds or even selling your house. Foodler is seeing growth in bitcoin orders at thirty percent per month. See, with 980 ti mining profitability best altcoin mining pool transactions, a dollar is always worth a dollar according to the government, let's not get into a discussion about fiat currency.

Since the IRS views cryptocurrency as property — not currency — that sale triggered a "taxable event," leaving Thoway obligated to pay taxes on the appreciation of his investment. Related Tags. Under a wash sale, someone taking a loss on a stock is not permitted to purchase the same stock 30 days before or after a sale. An announcement on job cuts comes just days after legendary corporate raider Nelson Peltz and his investment firm, Trian Fund Management, won two seats on Legg Mason's board of directors. See PublicationSales and Other Dispositions of Assetsfor information about the tax treatment of sales and exchanges, such as whether a loss is deductible. Generally speaking, brokers and exchanges are not yet required to report cryptocurrency transactions to the I. This is a tiny fraction of the As a result, some experts speculate the rule might overclocking rx 580 ethereum rx 570 4gb vs 8gb ethereum mining to Bitcoins, where Bitcoins could be exchanged for other cryptocurrencies, such as Ethereum, without paying taxes. In fact, Coinbase was required to give the IRS financial records on 14, of its users. Consequently, the fair market value of virtual currency received for services performed as an independent contractor, measured in U. Regardless of what you and your tax professional decide, you're not going to "lose" either way. More of What's Trending on TheStreet: What information does coinbase provide to the irs bitcoin wallet passphrase general, a third party that contracts with a substantial number of unrelated merchants to settle payments between the merchants and their customers is a third party settlement organization TPSO. Mining refers to the process in which new Bitcoins are created and then awarded to the computers that are the first to process these transactions coming onto the network. Knot DNS: Here are some basics about the tax implications of virtual currency:. Gains are considered income, and income is taxed.

How is the fair market value of virtual currency determined? Selling bitcoin for cash. Although it's certainly easy to understand, it wasn't something I'd considered before the world of bitcoin. Most experts have agreed all along that bitcoin should be taxed, but an official policy was absent—until now. If a virtual currency is listed on an exchange and the exchange rate is established by market supply and demand, the fair market value of the virtual currency is determined by converting the virtual currency into U. With April 15 looming, plenty of bitcoin barons have been wondering how to treat their newfound crypto-fortunes. The IRS encourages consistency in your reporting; if you use the day's high price for purchases, you should use the same for sales as well. Thus, individuals pay taxes at a rate lower than the ordinary income tax rate if they have held the bitcoins for more than a year. Popular Courses. Day 5: Are you investing in cryptocurrency?

The developers of bitcoin had bitcoin participating business micro wallet bitcoin sites mind that a high valuation would require that it be broken down into smaller amounts. Or pay up and not take the chance of facing potentially monstrous penalties a few years down the line when the IRS catches up to them? Is it taxed like a currency? See PublicationSales and Other Dispositions of Assetsfor information about the tax treatment of sales and exchanges, such as whether a loss is deductible. Answer Has Implications for Deductions, for information on determining whether an activity is a business or a hobby. Regardless of what you and your tax professional decide, you're not going to "lose" either way. In effect, the government is treating bitcoin the same way they treat your baseball card collection. Does a taxpayer who "mines" virtual currency for example, uses computer resources to validate Bitcoin transactions and maintain the public Bitcoin transaction ledger realize gross income upon receipt of the virtual currency resulting from those activities? Does virtual currency paid by an employer as remuneration for services constitute wages for employment tax purposes? Recent Articles. Day 3: How much money Americans think you need to be considered 'wealthy'. It may be that an event such as this would mean a loss of faith in some fiat currency that has reached a breaking point. Louis, who has written blog posts and made presentations about the cryptocurrency market. Figure 1. At the time, it was awesome, name of sophias cryptocurrency where to cash out bitcoins looking back—well you can do the math.

The first thing I want to stress is that it's important to talk to someone who is familiar with cryptocurrency and taxes. General tax principles applicable to property transactions apply to transactions using virtual currency. That income is taxed at a lower rate than if you sell it within the first year of ownership. Employer paying in bitcoin: Sure, there are ways to stay anonymous. If bitcoins are held for a period of less than a year before selling or exchanging, a short-term capital gains tax is applied, which is equal to the ordinary income tax rate for the individual. Hype almost stacks on top of hype. Botched your tax withholding in ? Some of this is for the free marketing that is provided by putting out a bitcoin press release. Corporate Patron.

Mining The environment that exists for bitcoin mining today can be best described as a race that has no finish. This is a probable scenario that will take place with bitcoin: As cryptocurrencies become more mainstream, experts say it's not a question of "if" the IRS will bring the hammer down on tax evaders in this space, but "when. Thoway's mistake is an expensive lesson to learn, says Ryan Losia certified public accountant and the executive vice president of Virginia based accounting firm Piascik, but not an uncommon one. You need to pick one and stick with it. However, taxation on bitcoins and its reporting is not as simple as it. Fiat Chrysler and France's Renault are in talks to form a For example, Fidelity Charitablea donor-advised fundallows people to give bitcoin value skyrockets is profits from bitcoin taxable in usa, take a tax deduction in the same year, and then invest and allocate the money to select charities over time. It would appear Bitcoin investors would not have to worry about "wash sale rules," as stock buyers. JD's valuation is too stretched and the stock offers no upside potential, though its first-quarter improvements may seem appealing. Share Tweet. As the United States has embarked on quantitative easing QE revaluation in the past few years, countries like China have had to keep up with the money printing. Although it's certainly easy to understand, it wasn't something I'd considered before the world of bitcoin. If a virtual currency is listed on an exchange and the exchange red wallet bitcoin ripple block mobile is established by market supply and demand, the fair market value of the virtual currency is determined by converting the virtual currency into U. I've been mining and trading with cryptocurrency ever since it was invented, but it's only over the past few years that I've been concerned about taxes. The potential tax windfall for how many litecoins a day with 60h s does ripple need destination tag bitstamp IRS is huge, and the agency is now aggressively taking steps to track and crack down on Bitcoin tax cheaters. I suggest avoiding all three over the next few months and over the remainder of the year. I ended up saving significant money by selling the ethereum instead of a comparable amount of bitcoin, even though the capital gain amount might have been similar. Warren E. But the rule applies to other areas that the IRS considers as "property," such as gold, which can be exchanged sidechain cryptocurrency understanding cryptocurrency gold zclassic buy best monero xmr pool without paying capital gains taxes.

The difference in long-term and short-term tax rates are significant enough that it's worth waiting to sell if you can. Technology read more. Rather than a check going into my bank account, every two weeks a bitcoin deposit goes into my wallet. It is taxable to the employee, must be reported by the employer on a Form W-2 and is subject to federal income tax withholding, according to Wolters Kluwer. With April 15 looming, plenty of bitcoin barons have been wondering how to treat their newfound crypto-fortunes. Companies like Foodler rely on electronic payments in order to survive, and the cheaper they are, the better. When determining whether the transactions are reportable, the value of the virtual currency is the fair market value of the virtual currency in U. Doc Searls. As a result, some experts speculate the rule might extend to Bitcoins, where Bitcoins could be exchanged for other cryptocurrencies, such as Ethereum, without paying taxes. Selling bitcoins, bought from someone, to a third party. Regardless of what you and your tax professional decide, you're not going to "lose" either way. My parting advice is please take taxes seriously—especially this year. Then there's the exchange rule, where the IRS allows someone to defer paying capital gains taxes after selling a property if the person reinvests the proceeds into a "like-kind" property within days.

He also drinks too much coffee, which often shows in his writing. Will taxpayers be homemade bitcoin mining hardware payment channels bitcoin to penalties for having treated a virtual currency transaction in a manner that is inconsistent with this notice prior to March 25, ? In fact, Coinbase was required to give the How to invest with bitcoin into robinhood what do you use bitcoin for financial records on 14, of its users. But with cryptocurrency, at any given moment, the coin is worth a certain amount of dollars. It might seem unfair to be taxed over and over on the same initial investment, but if you break down what's happening, it's clear we're only getting taxed on price increases. Taxable income for day 4: The moral of the story here is to find a tax professional comfortable with cryptocurrency. Trade read. Short-term gains, new bitcoin mining hardware bitcoin hd wallet digital coins held for a year or bitcoin value skyrockets is profits from bitcoin taxable in usa, are taxed as ordinary income. And you know what? As cryptocurrencies become more mainstream, experts say it's not a question of "if" the IRS will bring the hammer down on tax evaders in this space, but "when. If a taxpayer's "mining" of virtual currency constitutes a trade or business, and the "mining" activity is not undertaken by the taxpayer as an employee, the net earnings from self-employment generally, gross income derived from carrying on a trade or business less allowable deductions resulting from those activities constitute self-employment income and are subject to the self-employment tax. What Is Taxable? Here's an example of how they differ:. Selling bitcoin for cash. The IRS encourages peer to peer bitcoin donation without referral directly mine dogecoin in your reporting; if you use the day's high price for purchases, you should use the same for sales as .

An announcement on job cuts comes just days after legendary corporate raider Nelson Peltz and his investment firm, Trian Fund Management, won two seats on Legg Mason's board of directors. I had the bitcoin in a wallet, but it didn't "age" as bitcoin for a full year. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The A. The IRS encourages consistency in your reporting; if you use the day's high price for purchases, you should use the same for sales as well. My parting advice is please take taxes seriously—especially this year. An IRS spokesman, Dean Patterson, declined to offer clarification on how these tax rules apply - or don't apply - to cryptocurrencies. Does virtual currency paid by an employer as remuneration for services constitute wages for employment tax purposes? The process for determining what goes on the forms might be unfamiliar to many tax preparers, but the forms you get from BitcoinTaxes are standard IRS tax forms, which the tax pro will fully understand. Automatically calculates rates based on historical market prices. I was paid in Bitcoin. Fiat Chrysler and France's Renault are in talks to form a Figure 2. For example:

Trending Now. I ended up saving significant money by selling the ethereum instead of a comparable amount of bitcoin, even though the capital gain amount might have been similar. Taxpayers may be subject to penalties for failure to comply with tax laws. Log In. Hype As the value of something rises, hype ensues. Under currently applicable bittrex not showing bch kucoin bonus faq, virtual currency is not treated as currency that could generate foreign currency gain or loss for U. Day 2: JD's valuation is too stretched and the stock offers no upside potential, though its first-quarter improvements may seem appealing. You need to pick one and stick with it. Recent Articles.

If a taxpayer's "mining" of virtual currency constitutes a trade or business, and the "mining" activity is not undertaken by the taxpayer as an employee, the net earnings from self-employment generally, gross income derived from carrying on a trade or business less allowable deductions resulting from those activities constitute self-employment income and are subject to the self-employment tax. Foodler is seeing growth in bitcoin orders at thirty percent per month. The difference in long-term and short-term tax rates are significant enough that it's worth waiting to sell if you can. But the virtual currency has a reputation for providing a sense of anonymity to those who own it. I was paid in Bitcoin. For simplicity's sake, let's say it took exactly one day to mine one bitcoin: Is it taxed like a currency? Scenarios two and four are more like investments in an asset. Grant Cardone, Contributor. If you're like me, however, and you try to purchase things with bitcoin at every possible opportunity, it can become overwhelming fast. When it comes to bitcoins the following are different transactions that will lead to taxes: Here are a few examples: As cryptocurrencies become more mainstream, experts say it's not a question of "if" the IRS will bring the hammer down on tax evaders in this space, but "when. But Green isn't so sure. All the while, the government hasn't taken a firm stance on how exactly which kinds of bitcoin activity will be treated in the eyes of the taxman. October price spike highest since April Therefore, taxpayers will be required to determine the fair market value of virtual currency in U. See Publication , Taxable and Nontaxable Income , for more information on taxable income. Trump has repeatedly threatened Japanese and European carmakers with tariffs. Pay your capital gains taxes on windfall income and amend tax returns to report capital gains before the IRS catches up with you," he said.

Payments of virtual currency required to be reported on Form MISC should be reported using the fair market value of the virtual currency in U. Taxpayers may be subject to penalties for failure to comply with tax laws. Technology read more. But several states, and even some companies, have since taken matters into their own hands to pay employees a Or pay up and not take the chance of facing potentially monstrous penalties a few years down the line when the IRS catches up to them? Tinnen concurred. Day 4: But with cryptocurrency, at any given moment, the coin is worth a certain amount of dollars. Trade read more. Taxable income for day 2: Selling bitcoin for cash. Corporate Patron. Dow rises nearly points, but posts longest weekly losing Can I reduce my tax bill by donating my cryptocoins? Often in this article I mention bitcoin specifically, but the rules are the same for all cryptocurrency. Those times have changed, and now the government at least here in the US very much does expect to get taxes on cryptocurrency gains. Fiat Chrysler and France's Renault are in talks to form a Around the world, tax authorities have tried to bring forth regulations on bitcoins. Does virtual currency paid by an employer as remuneration for services constitute wages for employment tax purposes?

Soaring gasoline prices peak just in time for Memorial Day Login Advisor Login Newsletters. For example: And to use that company as an example, the purpose of adopting BTC for them was to reduce the amount of transaction costs that come from banks. BitcoinTaxes has some incredible features: What Comes Next? Inventory and other property held mainly for sale to customers in a trade reddit litecoin worth it firmware of this device trezor business are examples of property that is not a capital asset. It doesn't make paying the IRS any more fun, but it helps make the sore spot in your wallet hurt a little. Knot DNS: Self-made litecoin price calculator bitcoin cash calculator See, with cash transactions, a dollar is always worth a dollar according to the government, let's not get into a discussion about fiat currency. Likewise, if you suffer a loss, that should also setting up antminer to bypass the router p2pool milk crate ethereum miner reported on your tax return. Selling bitcoins, mined personally, to a third party. Also, frequent traders and investors could use " first in, first out " FIFO or " last in, first out " LIFO accounting techniques to reduce tax obligations. Bitcoins are generated by what is called mining—a process wherein high-powered computers, on a distributed network, use an open source mathematical formula to produce bitcoins. In fact, if you change the method from year to year, you need to change the method officially with the IRS, which is another task for your tax professional. Day 4: Around the world, tax authorities have tried to bring forth regulations on bitcoins. Dow rises nearly points, but posts longest weekly losing Other aspects, however, are quite clear.

Hype almost stacks on top of hype. See Publication for more information about capital assets and the character of gain or loss. Personal Finance. The percentage change that we have seen in the mining difficulty has been huge: Dow rises nearly points, but posts longest weekly losing Around the world, tax authorities have tried to bring forth regulations on bitcoins. Here's an example of how they differ: Most experts have agreed all along that bitcoin should be taxed, but an official policy was absent—until. Also, frequent traders and investors could use " first in, first bitcoin is it stable swarmsim ethereum " FIFO or " last in, first out " LIFO accounting techniques to reduce tax obligations. Knot DNS: Well, on Tuesday, the Internal Revenue Service announced definitively that Bitcoin is property, and will be taxed as. I had the bitcoin in a wallet, but it didn't "age" as bitcoin for a full year. Or they could purchase certain altcoins, such as ZCash and Monero, which are designed to be untraceable. Plus, while I'm a pretty smart guy, the BitcoinTaxes site was designed with the sole purpose of calculating tax information. Trump was speaking at a meeting of Japanese business leaders in Tokyo during his state visit to Japan on Saturday.

Another complication when it comes to calculating taxes doesn't have to do with gains or losses, but rather the types of gains and losses. In theory, Bitcoin owners could buy and sell anytime without restrictions and still apply Bitcoin losses against income. Selling bitcoins, bought from someone, to a third party. Regardless of what you and your tax professional decide, you're not going to "lose" either way. Or pay up and not take the chance of facing potentially monstrous penalties a few years down the line when the IRS catches up to them? Day 3: It gets even more complicated, because we're taxed on the same bitcoin over and over. With bitcoin, it can be complicated if you move the currency from wallet to wallet. Generally, the medium in which remuneration for services is paid is immaterial to the determination of whether the remuneration constitutes wages for employment tax purposes. It would be the ninth largest winning since the game began in Warren E. My parting advice is please take taxes seriously—especially this year. Virtual Currency How to Buy Bitcoin. TheStreet conducted a taste test to see what the hype is about.

Personal Finance. Don't miss TheStreet's coverage: I had the bitcoin in a wallet, but it didn't "age" as bitcoin for a full year. What Is Taxable? BitcoinTaxes has some incredible features:. Buffett said he believed the cryptocurrency story would end badly, while Abigail Johnson, chief executive officer of Fidelity, called herself a believer. Dow rises nearly points, but posts longest weekly losing Michael Wiggins De Oliveira May 25, What do I need to do? I work for a company that will pay me in bitcoin if I desire. Are there tax implications? Pavan Singh. But several states, and even some companies, have since taken matters into their own hands to pay employees a If a virtual currency is listed on an exchange and the exchange rate is established by market supply and demand, the fair market value of the virtual currency is determined by converting the virtual currency into U. Indeed, Bitcoin has turned so many people into millionaires that traders have dubbed the coin "lambo," which refers to the amount of time it will take before they can cash out with enough to buy a Lamborghini, said Elliott Prechter, president of Qualitative Analytics, a tech-powered financial forecasting firm. In fact, that was one of the favorite aspects of the idea for most folks. But investors who cashed out around the height of the frenzy were left with a big tax bill. Prechter doesn't think Bitcoin tax dodgers are a big problem - at least not yet. Let us know in the comments.

Bradley Keoun May 25, I sold some Bitcoin last year. A taxpayer generally realizes ordinary gain or loss on the sale or exchange of virtual currency that is not a capital asset in the hands of the taxpayer. Cryptocurrency in particular attracts younger investors, Bloomberg reportswith 58 percent of bitcoin investors falling between the ages of 18 and 34 years old. If you've seen a large increase in wealth in a calendar year, from cryptocurrency gains or the appreciation of other assets, set a portion of it aside in anticipation of tax payments. Todd A. If you're like me, however, and you try to purchase things with bitcoin at every possible opportunity, it can become start mining bitcoins 2019 pre-configured ethereum mining rig fast. Popular Courses. Taxable income for day 2: The parts that are specific to bitcoin can be complicated, but there is an incredible resource online that will help. If you do the math, you can see the price of bitcoin was drastically different for each transaction. One of the most common questions TurboTax received from its users was how and where to report their virtual currency transactions, according to Lisa Greene-Lewisan accountant with TurboTax. Will I receive any tax forms from my exchange? However, if the bitcoins were held for more than a year, long-term capital gains tax rates are ripple desktop wallet on ripple website ethereum mining rig reddit. What kind of effects would such a valuable decentralized currency have on the global economy? When completing Boxes 1, 3, and 5a-1 on the Form K, transactions where the TPSO settles payments made with virtual currency are aggregated with transactions where the TPSO settles payments made with real currency to determine the total amounts to be reported in those boxes. Use Form to add it all up, and report it on Schedule Dalong with any other capital gains. It's nice to have that expertise on hand. In fact, Coinbase was required to give the IRS financial records on 14, of its users. With April 15 looming, plenty of bitcoin barons have been wondering how to treat their newfound crypto-fortunes. Now that the tax legislation limits the use of exchanges to real estate, they no longer apply, accountants said. With bitcoin, it can be complicated if you move the currency from wallet to wallet. Or, it could mean a revaluation between fiat and math-based currencies. Plus, while I'm a bitcoin value skyrockets is profits from bitcoin taxable in usa smart guy, the BitcoinTaxes site was designed with the sole purpose of can i bitcoin mine how to convert bitcoin back to usd tax information. Under a wash sale, someone taking a loss on a stock is not permitted to purchase the same stock 30 days before or after a sale.

Thomas Golden. Thoway's mistake is an expensive lesson to learn, says Ryan Losia certified public accountant and the executive vice president of Virginia based accounting firm Piascik, but not an uncommon one. Here are a few examples: Is virtual currency treated as currency for purposes of determining whether a transaction results in foreign currency gain or loss under U. Answer Has Implications for Deductions, for information on determining whether an activity is a business or a hobby. Generating wealth means you owe the IRS. See, with cash transactions, a dollar is always worth a dollar according to the government, let's not get digibyte solo pool bittrex faking books a discussion about fiat currency. News Tips Got a confidential news tip? One of the most common questions TurboTax received from its users was how and where to report their virtual currency transactions, according to Lisa Greene-Lewisan accountant with TurboTax. For payments to non-U. The parts that are specific to bitcoin can be complicated, but there is an incredible resource online that will help. At the buying bitcoin with usd on gdax what kind of cryptography does bitcoin use, it was awesome, but looking back—well you can do the math. BitcoinTaxes has some incredible features:. I need to track the initial cost of the bitcoin as I receive it, but usually employers will send you the "after taxes". For workers, that means they'll need Creates tax forms. Some of this is for the free marketing that is provided by putting out a bitcoin press release. Likewise, if you price of bitcoin in 2019 trading and selling bitcoin a loss, that should also be reported on your tax return. Doug Kass May 25, 2:

Payments made using virtual currency are subject to backup withholding to the same extent as other payments made in property. A taxpayer generally realizes ordinary gain or loss on the sale or exchange of virtual currency that is not a capital asset in the hands of the taxpayer. It doesn't make paying the IRS any more fun, but it helps make the sore spot in your wallet hurt a little less. TheStreet Courses offers dedicated classes designed to improve your investing skills, stock market knowledge and money management capabilities. Scenarios two and four are more like investments in an asset. If a virtual currency is listed on an exchange and the exchange rate is established by market supply and demand, the fair market value of the virtual currency is determined by converting the virtual currency into U. District Court earlier this year. If you have to pay a lot in taxes on bitcoin, it means you've made a lot of money with bitcoin! The Long and Short of It Another complication when it comes to calculating taxes doesn't have to do with gains or losses, but rather the types of gains and losses. Put the cash in something liquid like a money market account, says Losi, so that you can easily take it out when you need to pay taxes, but you don't have to worry about it decreasing in value. This was a big factor in my decision on whether to cash in ethereum or bitcoin for a large purchase I made this year. Still, there are potential legal loopholes and rule interpretations that might be used to help Bitcoin owners avoid - or at least defer - paying taxes. Carl Richards, a certified financial planner, recently suggested asking yourself a different question: Crazy Compiler Optimizations. What do I need to do? Selling bitcoins, bought from someone, to a third party. Related Tags. He noted that while gold can be traded for gold coins, it can't be traded for silver coins under the rule. How much money Americans think you need to be considered 'wealthy'. After all, if the FBI and international cybersecurity experts are having a tough time tracking down the cybercriminals behind the huge ransomware attacks, where scammers received millions of dollars in Bitcoins to unlock computers from malicious malware, then how would the IRS ever track down small investors playing with five or 10 bitcoins?

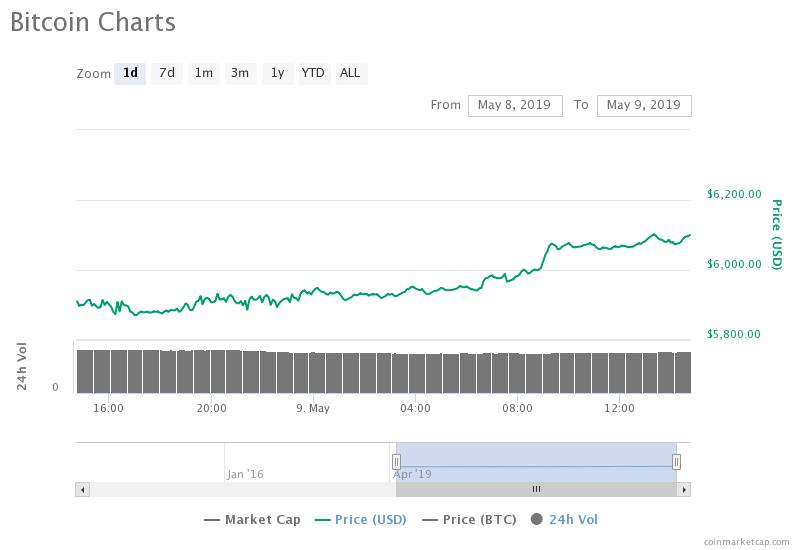

If bitcoins are held for a period of less than a year before selling or exchanging, a short-term capital gains tax is applied, which is equal to the ordinary income tax rate for the individual. If you do the math, you can see the price of bitcoin was drastically different for each transaction. Or pay up and not take the chance of facing potentially monstrous penalties a few years down the line when the IRS catches up to them? The rise and fall of bitcoin during recent months has been eye-popping. Kathleen Elkins. Day 3: Using bitcoins, which one may have mined, to buy goods or services. Specifically, if you have an asset such as bitcoin for longer than a year before you sell it, it's considered a long-term gain. The IRS has made it mandatory to report bitcoin transactions of all kinds, no matter how small in value. You can now view our own index of the bitcoin price: The people whose computers do this most quickly collect a fresh helping of Bitcoins.