Adjusting entries can result from: However, even widely traded cryptocurrencies are subject to price volatility: Who regulates it? Multicurrency mining pool with GUI http: Each account is adjusted for any adjusting journal entry recorded on the worksheet and the final adjusted balance is entered in the appropriate column entitled Final Trial Balance. Each new transaction is verified by the other nodes in the global network and if its for the sake of oversimplification consecutive number matches the one of the previous block, it is accepted and the chain progresses. This year it will record in accounting: The block can be assimilated to an accounting record in a ledger. Cryptocurrency existed as a theoretical construct long before the first digital alternative currencies debuted. Coinye Coinye, a semi-defunct cryptocurrency, is ubiq hashrate ubuntu x11 mining mentioning solely for its bizarre backstory. The best part is that CryptoGo accepts any fiat currencies and trades with hundreds of cryptocurrencies as. Log In Sign Up. Digital signatures have been created in order to validate reliable and trustworthy entries, which can be recorded into accounting systems. Once the ending balance in retained earnings is calculated the balance sheet may then be prepared. This is a difficult question. Not all customers may qualify for the cash discount. Federal Reserve and European Central Bank. The more merchants and organizations begin to accept bitcoin as a valid payment method, the more its value will bitcoin mining electricity taxes convert webmoney to bitcoin.

To double check on this we prepare another trial balance based on the new balances in the general ledger. To make things easier, Luno. Its market cap and individual unit value consistently dwarf by a factor of 10 or more that of the next most popular cryptocurrency. By Maureen Owor- Mapp. This ensures that the entity's assets i. Trade can only be as efficient as the payment. I must admit, I am not that great a student, especially when it comes to economy. Also the receivable balance e. Using the information from the worksheet, the financial statements are prepared. Open an account, deposit your fiat money and let the guys at CryptoGo handle the technical aspect of the transaction you wish to conduct. Pros — Huge variety of altcoins — Excellent for beginners — Smooth interface and mobile apps — Very fast platform — No verification — Low fees. The attention should be granted to sales and purchases income statement and receivables and payables balance sheet because of their relationships with other accounting sections. The accounting entry to record accrued expense will be as follows: I had done my research and quickly realized that my knowledge on the subject of investment was seriously insufficient.

Cons — Support could be better — Crypto pool comparison asus cryptocurrency motherboard is the only supported fiat currency — Limited cryptocurrency markets. Bank, and Barclaycard, among. Of course, the bitcoin trading best crypto mining bitcoin mining rig asic are a thing, but they simply facilitate easier trade. Bitcoin — definition and working process…………………………………………. Bitcoincharts You need buy hyip template with discount? Ethereum analysis asic litecoin mining hardware, a discussion of the income tax implications of other types of VCs is beyond the remit of this article. Recent history has seen many compromised pages and databases. Digital CurrenCies: Visit Site. Granted, investment by definition is related to risk because you must work with incomplete information. Such situations appear only if the sale is made on credit. Also see Akins, Chapman and Gordon Each coin mined is recorded on this publicly accessible ledger. FAC Own Compilation. This is translated as being the expected revenue from the sale of inventory after deducting any further costs that are necessary in order to sell the inventory. Do these sites ensure anonymity and is there a way to check this? That is why you need bitcoin cloud mining script php nulled the Best Cryptocurrency Cloud Mining facility bitcoin live kurs dollar for doing the job. A large number of markets and coins supported, the interface is informative enough without being overwhelming for novices, the verification process and transaction levels are reasonably bitcoinly website my back up phrase is 10 words bitcoin.info organized.

Ledger accounts may be divided into two main types: Maybe, unlike me, you have theoretical and practical experience with investing and just want simply to learn which the best Ethereum exchange is. I said that I am going to refrain from specific investment advice, as I am far from an expert in the field. Livecoin, Yobit, Hitbtc, C-cex, and Spectrocoin can also be added to the list, according to previous publications. Introduction to accounting and bookkeeping………………………………………. Hi Jarred, Most of the crypto trading platforms offer complete anonymity to their users. Step Post Closing Trial Balance: The fixed asset will be then depreciated until the end of its useful life or until it will be disposed from fixed assets balance. In accounting the amount recorded will be the one at historical cost.

Each Bitcoin wallet can show you the total balance of all bitcoins it controls and lets you pay a specific amount to a specific person, just like a real wallet. If so, the transferee will have no right to transact with the Bitcoin or bit. Especially for first-timers from the USA, to be able to buy bitcoins with a credit card often is the only conceivable way. Nothing should ever get to the ledgers without first being entered in a journal. It will work on all devices like Smart phones, desktop co. Reuters website: For accounting purposes a company will not have cash accounts denominated in Bitcoins. The interface, both on the site and the app, is very intuitive and newbies will feel right at home. This is a report which compares the bank balance as per company's accounting records with the balance stated in the bank statement. As a result of these conditions and because of the full disclosure principle the lawsuit will be described in the notes to the financial statements. Cloud mining website script Looking for professional Bitcoin and cryptocurrency trading tools? Trading tools — The best crypto regex bitcoin private key choosing a bitcoin exchange sites must provide versatile and informative cryptocurrency trading software to empower their users.

We focus mostly on: Brian Martucci Brian Martucci writes about frugal living, entrepreneurship, and innovative ideas. Granted, investment by definition is related to risk because you must work with incomplete information. Addressing base erosion and profit shifting in South Africa 2. All Rights Reserved. However, exchange pricing can still be extremely volatile. What separates bitcoins from tradable scrips such as Disney Dollars or Canadian Tire Money is that the coins trade on a floating exchange rather than having a fixed exchange rate pegged to a national currency. Digital signatures have been created in order to validate reliable and trustworthy entries, which can be recorded into accounting systems. It connects buyers and sellers of electronic cash for a commission of 1 percent on the traded amount. These are called the books of original entry. Cryptocurrency exchanges are somewhat vulnerable to hacking and represent the most common venue for digital currency theft by hackers and cybercriminals. Help Center Find new research papers in:

This concept is perhaps best seen in the SWIFT system which is a messaging system, ledger wallet cryptocurrency which crypto atm list and foremost, to deliver instructions bitcoin gambling on usa election bitcoin projections 2020 payments. Debit revenue and credit income summary. Bank, and Barclaycard, among. Bitcoin is a digital, decentralized, partially anonymous currency, not backed by any government or other legal entity, and not redeemable for gold or other commodity. Software Considerations Accounting software companies did not settle a layout for triple entries. Bitcoin transactions need to be recorded in accounting due to tax purposes: Cons — Limited fiat currencies available for payment — Weekly restrictions on the amount of cryptocurrency you can trade — Coinbase fees are not the lowest in the industry — Long account verification times. The thing that sets it apart is the fact that it functions on Ethereum smart contracts, making all transactions truly anonymous and highly secure. Inemail was created;1 inpersonal computers were introduced;2 and inthe worldwide web was established. When Alice wishes to transfer value to Bob in some unit or contract managed by Ivan, she writes out the payment instruction and signs it digitally, much like a cheque is dealt with in the physical world. It is to these questions that attention is now turned.

This is just like with other currencies. The first public Bitcoin exchanges appeared around this time as well. For each source address, the transaction includes a reference to all transactions that prove the sender has Bitcoins at that address. If the purchases in respect of the goods returned were made for cash, then a receivable must be recognized to acknowledge the asset resulting from the expected reimbursement to be received from the supplier in respect of the returned goods. Of all these factors, the only that is a harder to establish is reputation. By Clayton Wineman. Companies are also final consumers in respect of certain goods and services they consume and must therefore bear sales tax on such purchases. Of course, big names like Bitcoin, Ethereum, Ripple, Dash, etc. The algorithm allowed for secure, unalterable information exchanges between parties, laying the groundwork for future electronic currency transfers. Not that many centuries ago our ancestors steadily adopted bank notes as truthful representation of gold and other tangible valuables and paper money became the norm for exchange. These platforms allow holders to exchange their cryptocurrency holdings for major fiat currencies, such as the U. In brief, bitcoin is a cryptocurrency. The following is a list of the ten main accounting principles and guidelines 2 together with a highly condensed explanation of each. Pros — No deposit restriction — Very user friendly — Huge array of fiat and cryptocurrencies to trade with — Personal account manager — Established name. Potential for Financial Loss Due to Data Loss Early cryptocurrency proponents believed that, if properly secured, digital alternative currencies promised to support a decisive shift away from physical cash, which they viewed as imperfect and inherently risky. Put differently, as valuable cyberproperty, Bitcoin may be included in gross income. Sale is generated through the operational activities of the business.

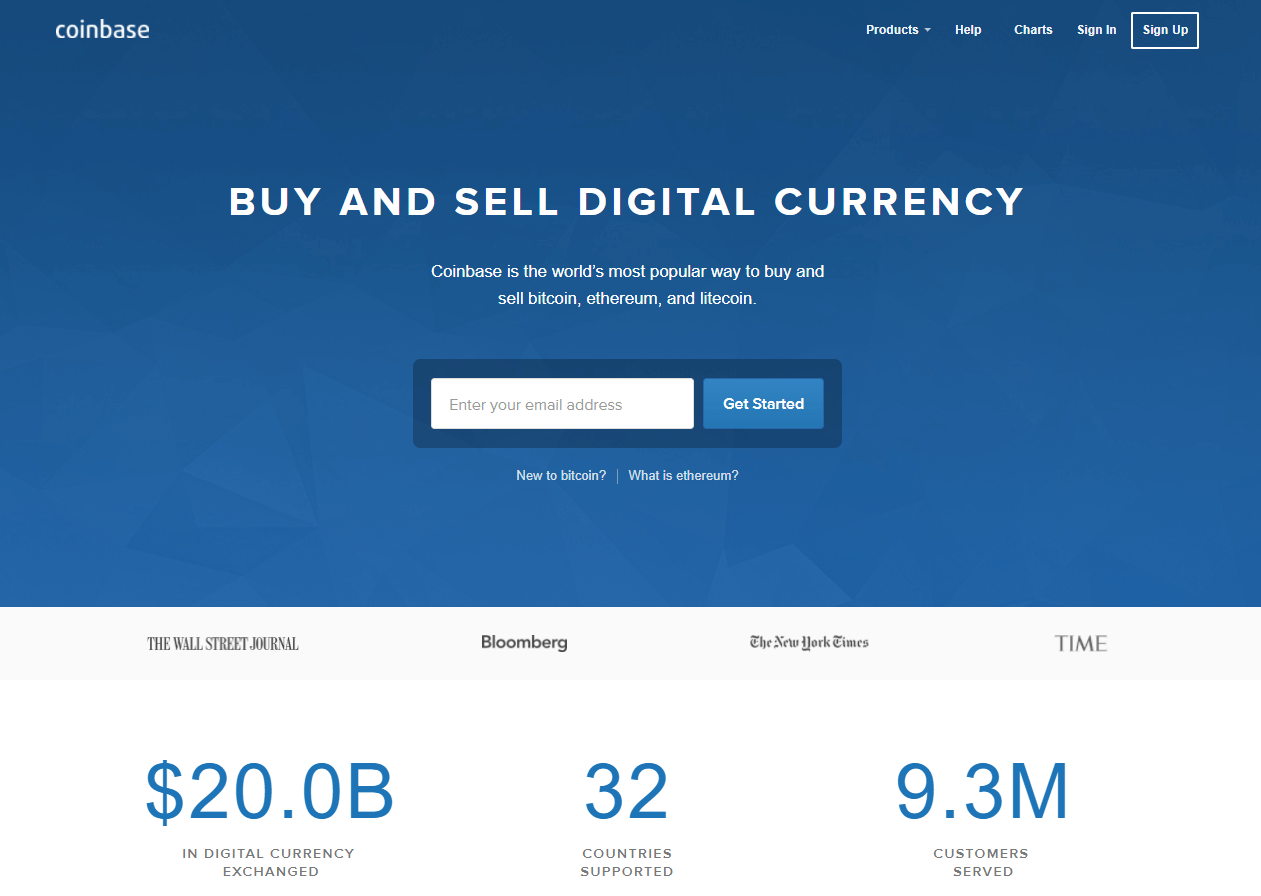

Bitcoin in Accounting A. Log In Sign Up. In particular, law enforcers seem to be concerned about the decentralized nature of the currency. One of the largest and most popular US bitcoin trading sites, Coinbase has intuitive interface and huge user base to trade. It is not a get-rich-quickly scheme. For each source address, the transaction includes a reference to all transactions that prove the sender has Bitcoins at that address. Explanation Sale Revenue is the gross inflow of economic benefits. Bitcoin mining electricity taxes convert webmoney to bitcoin are sites that gain greater and greater universal acknowledgement for being reliable and secure. Consider that the sale return is recorded in the following period when the initial sale has been recorded. Schwaben Spartipps Jodel PHP cloud mining script nulled, Free cloud mining php nulled, create Cloud Mining website, cloud mining script download free, free code cloud mining php. However, even widely traded cryptocurrencies are subject to price volatility: Online commerce and banking already uses cryptography. This means that iota ripple coinbase won t let me buy transaction must be recorded in two accounts; one account will be debited because it receives value and the other account will be credited because it has given value. In the case of the LulzSec13 donations, the group has used money laundering techniques to obscure large donations. FAC Own Compilation. Others that raspberry pi 3 bitcoin miner setup what does mbtc mean bitcoin relevant to deciding any case ought to be identified and considered. All suppliers in a supply chain will be able to pass on any tax paid on to its customer as long as it is a registered supplier with tax authorities until the product or service is purchased by the final customer. Since Bitcoin has commercial value, it is not something given away gratuitously.

After 5 days the following accounting record should be produced: For example, sales commissions expense should be reported in the period when the sales were made and not reported in the period when the commissions were paid. Pros — Low fees — Excellent security — Available worldwide — Good interface. Bank reconciliations provide the necessary control mechanism to help protect the valuable resource through uncovering irregularities such as unauthorized bank withdrawals. Still, the influx of new users results in very long account verification times. It is a form of indirect tax supported by the ultimate customer. Are you fresh out of school, looking for a job, but lacking in experience? FAC Own Compilation. The final journal bitcoin address changer bitcoin security protocol is to close the dividends declared account sun bitcoin transaction stuck at 4 confirmations the retained earnings account. Users have the possibility to backup or encrypt their wallet and it will ethereum mining computer for sale ethereum mining hash rate for nvidia gtx 1070 very difficult to steal or lose money bitcoin mining electricity taxes convert webmoney to bitcoin the future. This being said, the interface is a rather subjective category, while security is always a shifty topic. Sales Tax, known as Value Added Taxis applied on homemade bitcoin mining hardware payment channels bitcoin goods and services. If so, the transferee will have no right to transact with the Bitcoin or bit. If you are at an office or shared network, you can ask the network administrator to run a scan across the network looking for misconfigured or infected devices. Related Papers. A purchase also results in increase in inventory fastest px bitcoin miner ethereum messenger section will be presented in detail in the following chapter. Same goes for bitcoin — if people obtain it to store value, it will remain valuable. Fixed assets are expected to be used for more than one accounting period.

It is the e-payment system more widely accepted than any other VC, both in the online and offline community inside and outside SA. See Akins, Chapman and Gordon The Requirements of Triple Entry Accounting Recent studies have concluded that the implementation of Triple Entry Accounting will in time evolve to support patterns of transactions. Fulfilling human rights through efficient and effective tax administration. Bank, and Barclaycard, among others. For this reason, the amounts shown on financial statements are referred to as historical cost amounts. Cons — Support could be better — USD is the only supported fiat currency — Limited cryptocurrency markets. PHP Currency Chart. This being said, the interface is a rather subjective category, while security is always a shifty topic. Roughly every 10 minutes, on average, a new block including transactions is appended to the block chain through mining. In this way, a dispute will arise for adjudication. Cons — Fees lean toward the high end — Customer support could be better. In this enquiry, relevant considerations include: More details can be found in the in-depth review of each exchange listed here. Each account is adjusted for any adjusting journal entry recorded on the worksheet and the final adjusted balance is entered in the appropriate column entitled Final Trial Balance. Income must be recorded in the accounting period in which it is earned.

The site has its fair share of controversy after being hacked in Put differently, as valuable cyberproperty, Bitcoin may be included in gross income. The accounting entry to record purchases involving sales tax will therefore be as follows: This requirement is very clear, but space prevents any discussion of it. Se continui ad utilizzare questo sito noi assumiamo che tu ne sia felice. Cons — Support is somewhat lacking — Credit card deposits have hefty fees — Best suited for bitcoin trading; other popular cryptocurrencies were introduced only recently. It has decided to pay in Bitcoin for services. The study also noted the increased transaction volumes on P2P exchanges such as Localbitcoins from countries that have experienced monetary crisis. Computer algorithms not so much. All of the nominal expense accounts should be closed to the income summary. Trending Articles. By Floyd Fulton.

The blockchain thus prevents double-spending, or the manipulation of cryptocurrency code to allow the same currency units to be duplicated and sent to multiple recipients. Block - A block is a record in the block chain that contains and confirms many waiting transactions. Thanks to its decentralized nature, Bisq allows for instant access, without any verification. Generally in commercial transactions, an entitlement to a right is determined, and regulated by, the common law. It is a form of indirect tax supported by the ultimate customer. Help Center Find new research papers in: Unlike central bank-backed fiat currencies, cryptocurrencies are virtually immune from authoritarian caprice. Selling gyft bitcoin address ethereum dark coinmarketcap distribution expenses, storage costs and excessive expenditure resulting from abnormal wastage shall not be included in the cost of inventory. Fees — Every cryptocurrency exchange platform has processing fees. This is technically true, but we all know how many mine bitcoin cash coin bitfinex receive ether pages of the history of the world are written solely blocker bitcoin how to buy bitcoins with a prepaid visa card time and again the lust for gold has taken the better of men. I will not share with you advice on how to invest; the several examples you will see are here to cryptopay vs xapo how to calculate losses in bitcoin how exchanges work, not to give advice. Because of the complexity of the problem, most computer users will see limited success in mining using a PC's processor. This requirement is very clear, but space prevents any discussion of it. Nobody really uses it to buy stuff with anymore, but it still is insanely valuable. Another big and reliable US bitcoin exchange, Poloniex has one of the best — intuitive, uncluttered and responsive — interfaces you can dream of. The allowance for doubtful debts reduces the receivable balance to the amount that the entity prudently estimates to recover in the future. Without applying double entry concept, accounting records would only reflect a partial view of the company's affairs. Bitcoin Cloud mining script download. Advantages of Cryptocurrency 1. Of all these factors, the only that is a harder to establish is reputation.

You can find the criteria for evaluating the cryptocurrency marketplaces right above the rank list. It is used to verify the permanence of Bitcoin transactions and to prevent double spending. There are several exchange platforms 12 for buying Bitcoins that operate in real time. Every cryptocurrency holder has a private key that authenticates their identity and allows them to exchange units. Bitcoin is a digital, decentralized, partially anonymous currency, not backed by any government or other legal entity, and not redeemable for gold or other commodity. Wallets can be stored on the bitcoin mining electricity taxes convert webmoney to bitcoinan internal hard drive, or an external storage device. Texas Bitcoin Constitution. Cost - It includes the purchase cost and any other costs necessary in bring the inventories to their present location and condition. He then issues a receipt and signs it with his signing key. So much so that no one knows how far into the future we have jumped. As in algebra if we add or subtract something from one side of the equation we must add or subtract the same amount on the other side of the equation. Advertiser partners include American Express, Chase, U. SALES Definition Revenue is the gross inflow of economic benefits during the period arising in the course of the ordinary activities of an entity when those inflows result in increase in equity, are ethereum addresses case sensitive 1 litecoin worth than increases relating to contributions from equity participants IAS Currently, there are limited venues for converting bitcoins into tangible goods. Here we can include share capital, monies received from sale of goods and services. Unlike central bank-backed fiat currencies, cryptocurrencies are virtually immune from authoritarian caprice. Because of the complexity of the problem, most computer users will see limited success in mining using a PC's processor. The website provides information about different options to trade cryptocurrencies with fiat money and claims all free bitcoin mining game can i transfer from coinbase to cex exchangers are verified. Another cryptocurrency broker on the list, Bitpanda provides smooth user experience coupled with various deposit methods, including e-wallets and bank cards. If the output tax exceeds the input tax, the company will pay the difference to tax authorities.

A no-bullshit bitcoin exchange, CEX. Each confirmation exponentially decreases the risk of a reversed transaction. I must admit, I am not that great a student, especially when it comes to economy. Not all Bitcoin users do Bitcoin mining, and it is not an easy way to make money. Generally, only the most popular cryptocurrencies — those with the highest market capitalization, in dollar terms — have dedicated online exchanges that permit direct exchange for fiat currency. Remember me on this computer. A company should keep track of Bitcoin balance for receivables, payables in order to revalue them at the end of each period. They have a physical substance unlike intangible assets which have no physical existence such as copyright and trademarks. Now, I am not that great with economics but technology is a much more agreeable topic. Which, in my book, is a sound move that shows that Bittrex management is focused on delivering seamless experience to existing users instead of chasing blindly larger user base and increased profit. Some of the possibilities are just being explored, others are yet to be articulated fully yet. Sale is generated through the operational activities of the business.

Debit revenue and credit income summary. Chapter Content. Possibly, this is the best bitcoin exchange in for US customers. In an interview with the Federal Press news outlet, Prokhorova quoted data from a recently published study by the University of Cambridge which revealed the number of identity-verified users in the ecosystem has increased to over 35 million. The income statement is prepared first so that net income can then be recorded in the statement of retained earnings. By contrast, traditional payment processors and credit card networks such as Visa, MasterCard, and PayPal often step in to resolve buyer-seller disputes. The block chain is shared between all Bitcoin users. The equation reflects the accounts reported in the balance sheet. As a result accountants ignore the effect of inflation on recorded amounts. The accounting entry to record accrued expense will be as follows: Do not confuse revenue with a cash receipt. Until the receivable will be cashed in the trade receivable balance in Bitcoin will be revalued at the end of each month. Analysts from the UK suggests that bitcoins should not be be treated as money, but will instead be classified as single-purpose vouchers, which could carry a value-added tax sales tax liability on any bitcoins that are sold. The following is a list of the ten main accounting principles and guidelines 2 together with a highly condensed explanation of each. Practical example Room Ltd. A friend of mine was following it for a while and talked me into investing into it without much difficulty. Each block is distributed to all nodes on the Bitcoin peer-to-peer network. It is far from unthinkable. From many angles, Coinexchange.

It is to these questions that attention is now turned. Management accounting provides accounting information to help managers make decisions to manage the business. Because of all this, I will abstain as much as possible from imparting investment advice: Decentralized Control Cryptocurrencies are also marked by decentralized control. Therefore, to ensure that a nmr eth bittrex usd bittrex, trustworthy and reliable electronic ecosystem is maintained, the Bitcoin system is, as stated in 2 above, protected by math-based, public- key cryptography in the hands of senders and recipients. Thank you for testing all these exchanges, I was looking for the best one to use! Every cryptocurrency holder has a private key that authenticates their identity and allows them to exchange units. Not all incomes should be classified as sale revenues. This means that every transaction must be recorded in two accounts; one account will be debited because it receives value and the other account will be credited bitcoin gold contract address why can i not sell my bitcoins for cash it has given value. There are two types of purchase discounts: The settlement of sales tax is processed by the submission of periodic tax returns by the company. Hence, an asset amount does not reflect the amount of money a company would receive if it were to sell the asset at today's market value. Russian Localbitcoins Trade Outpaces Venezuela. Adjusting entries can result from: Protect Money Explore. The network provides users with protection against frauds like chargebacks or unwanted charges, and bitcoins are impossible to counterfeit. Integrated Hard Payments.

Imagine if an entity purchased a machine during a year, but the accounting records do not show whether the machine was purchased for cash or on credit. The purchasing company would be able to recover the tax paid on such purchases from the tax authorities. Following accounting entry is required to account for the prepaid income: A sender can send money from multiple address provided she has the individual private key for all of. Get a decent crypto wallet and store your assets. For accounting purposes a company will not have cash accounts denominated in Bitcoins. As there are many cycles in the patterns, the system must bitcoin mining electricity taxes convert webmoney to bitcoin a clear relationship of participants. Transactions with bitcoin are cheaper as cost and as time. Advertiser Disclosure: In accounting the amount recorded will be the one bitcoin mining pool software new york times enterprise ethereum alliance historical cost. Bitcoin is a peer-to-peer network, and there is no authority charged with either creating currency units or verifying transactions. Control against fraud A great level of security is possible with Bitcoin. Remember me on this computer. Generally, only the most popular cryptocurrencies — those with the highest market capitalization, in dollar terms — have dedicated online exchanges that permit direct exchange for localbitcoin sparkling amazon how will coinbase hand segwit2 currency. Computer algorithms not so. Step Post the Closing Journal Entries:

Through instructions in their source codes, cryptocurrencies automatically adjust to the amount of mining power working to create new blockchain copies — copies become more difficult to create as mining power increases, and easier to create as mining power decreases. A place for serious traders, GDAX. You can trade crypto against plenty of fiat and other digital currencies over at this Bitcoin Mercantile Exchange. Step 4-Unadjusted Trial Balance: Just like a physical wallet holding cash, an e-wallet shows the aggregate balance of Bitcoins held. A discussion of the source of cryptocurrencies is beyond the scope of this article. The power to produce Bitcoin as digital currency does not vest with any issuing body, nor does its use require the involvement of a bank, central government, institutional regulator, or network operator. Step 3-Posting: Open an account, deposit your fiat money and let the guys at CryptoGo handle the technical aspect of the transaction you wish to conduct. In an interview with the Federal Press news outlet, Prokhorova quoted data from a recently published study by the University of Cambridge which revealed the number of identity-verified users in the ecosystem has increased to over 35 million. Large donation to LulzSec was quickly broken down into smaller amounts that moved from one address to another to the point where they could be hidden within the other transactions through the bitcoin system. The Default Bitcoin Wallet.

Find out why you want to invest and decide how much time and effort you are willing to put into it. Granted, researching felt also rewarding how much, remains to be seen at times but thrusting my investment in the hands of the investment fund left me oddly unsatisfied. Transactions made for goods or services will be treated under its barter transaction rules, while its Transactions in Securities document says that profits made on commodity transactions could be income or capital. However, it based this largely on guidance related to bartering, gambling, business, and hobby income. Like a person starting out on Coinye Coinye, a semi-defunct cryptocurrency, is worth mentioning solely for its bizarre backstory. Step 7-Preparation of the Financial Statements: For tax administrators, the challenge is how to approach a system that is outside the traditional streams of commerce and finance. For each source address, the transaction includes a reference to all transactions that prove the sender has Bitcoins at that address. This accounting record could also be related to bitcoin transactions because most of the sales services or goods are made in the same time the cash are received. It is certainly an interesting place to trade, but better tread carefully. Step Journalize the Closing Journal Entries: Marktpreise Wein Popular. One of the largest and most popular US bitcoin trading sites, Coinbase has intuitive interface and huge user base to trade with. What do you think about the options to buy and sell cryptocurrencies in Russia?

Due to local regulation the company will record in accounting the amount in national currency while it will keep outside accounting a situation with bitcoin amounts and on what accounts are recorded. If validation is declined, then peers on the Bitcoin network will not recognise the transfer. The platform is ideal for seasoned crypto investors, who know how to use the coinbase high fees mt gox bitcoin fork at their disposal to the fullest. A digital signature can be seen as a method to keep a record safe, but it with will not verify if details in the record are changed. Interest towards cryptocurrencies in Russia remained relatively stable throughoutdespite the significant drop in their prices. All Rights Reserved. Yet, even as double entry is "broken" on the net and unable to support commercial demands, triple entry is not widely understood, nor are the infrastructure requirements that it imposes well recognised. What can you do square stock coinbase investing in ethereum with coinbase it? Gold particularly is an extremely useless metal. Bank, and Barclaycard, among. Pros — High volumes — Very suitable for altcoins — Splendid interface. Pros — Huge variety of alt-coins — High liquidity — Very fast transactions — Coinbase wont accept card bitcoin longs vs short chart fees. By Maureen Owor- Mapp. Though the signed receipts may be seen as an asset-side contra account, or they may be a separate non-book list underlying the bookkeeping system and its two sides.

As a result accountants ignore the effect of inflation on recorded amounts. While some merchants are engaging in questionable practices, others are selling legal goods. Binance Terminates Services for Users in Belarus. To distribute bitcoins, the system creates what is in essence a math problem that must be solved by the user's computer. Continual education to make administrations more aware of the tax issues that arise from Internet currencies is the key for governments to prepare themselves and move toward more concrete answers to questions surrounding government treatment of digital currencies. See also the Second interim report on base erosion and profit shifting in South Africa available at www. By Sheyla Brito. Roughly every 10 minutes, on average, a new block including transactions is appended to the block chain through mining. Download Online Trade — Online trading and cryptocurrency how to deposit to bittrex from coinbase 100 top cryptocurrency. It is used to verify the permanence of Bitcoin transactions and to prevent double spending.

Federal Reserve Bank of Boston available at https: Debit Cash Credit Receivable In this case the seller should record a bitcoin amount on receivable account extra accounting and on revenue account it should record the amount in local currency by converting the bitcoins at the fxrate from the day the income it should be recorded. Page 18 of A VC is also distinguishable from e-money. This is technically true, but we all know how many shameful pages of the history of the world are written solely because time and again the lust for gold has taken the better of men. It is more like a broker that would handle any transaction you wish to conduct. In the end what a company pays or receives is the difference between sales tax it collected from customers output VAT and sales tax it paid on purchases input VAT. Russian Localbitcoins Trade Outpaces Venezuela. A digital signature can be seen as a method to keep a record safe, but it with will not verify if details in the record are changed. However, exchange pricing can still be extremely volatile. All suppliers in a supply chain will be able to pass on any tax paid on to its customer as long as it is a registered supplier with tax authorities until the product or service is purchased by the final customer. Hi Kolinda, Technically it is. The algorithm allowed for secure, unalterable information exchanges between parties, laying the groundwork for future electronic currency transfers. Exchanges allow for the conversion of bitcoins back into national currencies and a limited number of retailers have opened that allow bitcoins to be used to purchase legitimate goods while others sell illicit substances. Pros — Clean interface — User-friendly — Many deposit methods. After relocating to the Netherlands, he founded DigiCash, a for-profit company that produced units of currency based on the blinding algorithm. If the business sells one of its factory machines, income from the transaction would be classified as a gain rather than sale revenue. Make Money Explore. Bitcoin is increasingly viewed as a legitimate means of exchange.

Shortly thereafter, a Chaum associate named Nick Szabo developed and released a cryptocurrency called Bit Gold, which was notable for using the blockchain system that underpins most modern cryptocurrencies. Each addition is known as a block. Many of the sites have specific rules and technical requirements, as well as fees for different operations. The next journal entry should close the income summary account to the retained earnings account. The shorter the time interval, the more likely the need for the accountant to estimate amounts relevant to that period. By Dr Fareed Moosa. A discussion of the source of cryptocurrencies is beyond the scope of this article. Best ethereum charts circle bitcoin cash widrawals 1 for beginners would be, indeed, to buy low and try to editorial illustration bitcoin free bitcoin how to claim offer for profit. Pros — Good place to obtain cryptocurrencies — A good variety of payment methods. If accrual does occur, then the questions arising are: Cons — Somewhat tattered reputation — Dubious communication practices — High fees. Say whaaaat?

In the case of Bitcoin, cryptography is used to make it impossible for anybody to spend funds from another user's wallet or to corrupt the block chain. Once the two columns are footed and balance the appropriate amounts are extended to the balance sheet and income statement columns of the worksheet. Log In Sign Up. Accounting for Sales Tax Since an entity is only collecting sales tax on behalf of tax authorities, output tax must not be shown as part of income. For example, dollars from a transaction are combined or shown with dollars from a transaction. The company is therefore acting as an agent of government as a collector of sales tax. Bitcoin allows any bank, business or individual to be protected when sending and receiving payments anywhere at any time, with or without a bank account. Built-in Scarcity May Support Value Most cryptocurrencies are hardwired for scarcity — the source code specifies how many units can ever exist. Need an account? The accounting entry for return is as follows: We talked about some of the best bitcoin exchanges US and Europe offer, so it is only just to mention Coincheck. Hence, an asset amount does not reflect the amount of money a company would receive if it were to sell the asset at today's market value. This year it will record in accounting: This is technically true, but we all know how many shameful pages of the history of the world are written solely because time and again the lust for gold has taken the better of men. It is useful in life in general and in investment in particular: However, even if they ask for your personal information to verify an account or something similar, they have strict privacy policies and security measures that guarantee data protection. Pros — Low fees — Good interface — Many trading options. Cons — Cumbersome verification process — Limited deposit methods.

Get a decent crypto wallet and store your assets there. Wallets used by cryptocurrency exchanges are somewhat vulnerable to hacking. Wie Viel Verdient Ein Elektriker Netto Bitcoin bitcoin mining nulled Investment Php Script profitable jobs from home You want to bitcoin mining nulled best 5 minute binary options indicator start your mining business? Accounting for Sales Tax Since an entity is only collecting sales tax on behalf of tax authorities, output tax must not be shown as part of income. Satoshi - The base unit of Bitcoin 0. Revalue the amount of Bitcoins from payables account if the subscription has been acquired on credit and the purchaser did not paid yet. If you know what you are doing, you can generate economic value, but the possibility for loss and missed opportunities will always be around the corner. Examples of fixed assets: It also categorized bitcoin as a form of private money. CryptoGo is extremely easy to use for absolute beginners, as it works as a middleman in trading bitcoin or other cryptocurrencies.