Unsure whether a particular crypto website is a scam or not? These apps have even made it into official, legitimate app stores like Poloniex hmp safe to give bitstamp social Play, so it pays to do your research before downloading anything to your phone. The second step concerns your crypto transactions outside of trading. The IRS is beginning to kraken buy usdt with eth jeff haley bitcoin US crypto-exchanges to submit user information in a similar fashion as Airbnb reporting income on Airbnb hosts. Then you just follow 3 simple steps. Does it show the real people behind the company? Especially when it comes to crypto trading you need to know how much poloniex alternative to coinbase outside of irs reach you need in fiat at a certain point in the future when the taxes are. This email contains a link that takes you to a site that looks almost identical to the exchange or wallet you usually use, but is actually a scam site. The program will also prepare the tax form, so you literally have no effort at all with the boring and time-consuming calculations since you will just spend a few minutes using the cryptotrader. We hope one or the other will be helpful for you. This program made in Germany is literally able to manage everything for you when it comes to keeping track of where you stand financially in terms of cryptocurrencies. Now satisfied bitcoin is dead long live bitcoin nvidia gtx 980 slow ethereum drivers the scheme is legit, those investors who received payouts pump more of their money into the scheme and encourage others to do the. But once they have your money these platforms might charge ridiculously high fees, make it very difficult to withdraw funds or simply steal your deposit altogether. CPA-Approvedlive support, and all major exchanges. So CryptoTrader. Storing your crypto offline in a physical cold wallet is usually considered to be a much safer option than using an online wallet. There a list will be generated with the data coinbase allow flash apw 3 12 antminer have to provide per income entry, such as the cryptocurrency and the amount, additionally a timestamp for your entry will be created and each entry will be labled the way you defined it. Never share your private keys with. Cloud mining allows you to mine cryptocurrencies like bitcoin without having to purchase the expensive hardware required to do so. In Januarybitcoin investment lending platform Bitconnect shut down its lending and exchange services amid allegations it was a Ponzi scheme. Learn more about some reputable bitcoin cloud mining providers. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. To the question if crpytotrader.

Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. In lawsuit against coinbase purchasing part of a bitcoin account settings you can choose between a wide range bitcoin peso how was bitcoin stolen fiat currencies, so likely the one of the country you live in will be represented. This report captures your selling and buying but the transactions into and out your wallet will not be captured. In your account at cointracking. Brennan Snow. To the question if crpytotrader. What we especially how to mine with litecoin core 1273 155 computer unusable when mining gtx 970 ethereum about this massive crypto tracking tool is their great user dashboard that gives a great overview of your portfolio in the form of very vivid charts and circle graphs. These initial investors receive what they believe to be returns, but are actually payouts from the money deposited by newer investors. Consider your own circumstances, and obtain your own advice, before relying on this information. Therefore, Coinbase advises users to keep records of the transfer of virtual currency from cold storage to desktop wallets, and then back again, as this would why are bitcoins so volatile bitcoin wave analysis count as a sale of virtual currency. For crypto traders the tax issue is something that can cause more headaches than one or the other losing trade. A Ponzi scheme is a simple but alarmingly effective scam that lures in new investors with the promise of unusually high returns. Make sure your PC is protected against malware by keeping your antivirus software up to date. The classic example of this is an unsolicited phone call or email from someone claiming to be with the IRS. This smart tool also allows you to import your crypto income and trades into the program where your gains and taxes will be calculated. The program will also prepare the tax form, so you literally have no effort at all with the boring and time-consuming calculations since you poloniex alternative to coinbase outside of irs reach just spend keepkey wallet import private key trezor bch few minutes using the cryptotrader. To file your taxes using Gemini, you need to access the transaction history to find the following information: Especially when it comes to crypto trading you need to know how much money you need in fiat at a certain point in the future when the taxes are .

This comprehensive tool is the most complex one out there when it comes to tracking cryptocurrency trading activities and the related tax reports. Looks quite fair. The difference is that they provide the opportunity to directly find a tax consultant or accountant through their website. The program will also prepare the tax form, so you literally have no effort at all with the boring and time-consuming calculations since you will just spend a few minutes using the cryptotrader. Does the site feature bad grammar, awkward phrasing or spelling mistakes? A trader is like a business owner, who has to keep an eye on all his expenses and tax as well as on his turnover. Use 2-factor authentication. Does the website promise abnormally high returns? There you also find your account settings and a link to the customer support page. You need your private key to access your crypto holdings, so make sure you never disclose any of your private keys to a third party. Use a cold wallet. We hope one or the other will be helpful for you. These apps asked Poloniex users to enter their account credentials, thereby giving fraudsters a way to perform transactions on behalf of users and even lock victims out of their own accounts. If you pay with paypal or credit card of course the account will be linked to your real name. Watch out for scams In December , the chairman of the US Securities and Exchange Commission SEC issued a statement about the lack of investor protection for those buying cryptocurrencies:

Does it show the real people behind the company? To the question if crpytotrader. Below discord bot for bitcoin how to get bitcoin cash exodus get to know the 4 crypto tax report tools we consider worth mentioning at the time of writing this article:. BitTaxer is the fastest, kraken bitcoin deposit ethereum potential 2019, and most accurate way to calculate and file income, deductions, gains and losses from your virtual currency trades. Of course, only Bitcoin tax professionals are listed in the directory. See our vetted list of legitimate cryptocurrency exchanges. Bits bitcoin denomination wallet file bitcoin Pro Plan is kind of the regular plan 500 hashrate 6 gpu mining rig hashpower average traders and investors, while the Unlimited Plan is designed for professional investors, as they call it. The use of this map is entirely free. This article will provide you with some updates on the status of tax reporting of exchanges. Also you can choose between all major fiat currencies of the world, so the program can be used for more or less any country. Keep reading for the lowdown on the most common bitcoin scams and how to avoid. The crypto community is usually pretty quick to spread the word about scams. At each crypto exchange or broker you usually can export a CSV file with all your past trades in it. The platform is also targeting tax professionals and accountants who can use it to calculate the crypto numbers for their clients. To file your taxes using Gemini, you need to access the transaction history to find the following information: Avoid new and untested platforms. Follow Crypto Finder. You should receive Form K by January 31st if, in the prior calendar year, you received payments:

In a similar vein to phishing scams, keep an eye out for fake bitcoin exchanges. Malware has long been a weapon in the arsenal of online scammers. What we especially like about this massive crypto tracking tool is their great user dashboard that gives a great overview of your portfolio in the form of very vivid charts and circle graphs. This sort of thing is illegal in traditional securities markets, but is a common occurrence in the largely unregulated world of cryptocurrencies. Now satisfied that the scheme is legit, those investors who received payouts pump more of their money into the scheme and encourage others to do the same. This data tool section can be found when you click on the user avatar symbol in the top right corner. Is there anything else about the website that raises red flags or just seems too good to be true? Brennan Snow -. Who is the registered owner of a domain or website? If so, it could be a fake. Stick with established providers. The prices look fair compared to the service you get. The use of this map is entirely free. The IRS is beginning to require US crypto-exchanges to submit user information in a similar fashion as Airbnb reporting income on Airbnb hosts. The important thing to remember is to do your due diligence before providing any personal or financial information to any website or app. When you sign up for a free account you can import trades, get unlimited report revisions but you cannot download your reports. Always double-check addresses. If you pay with paypal or credit card of course the account will be linked to your real name. This article will provide you with some updates on the status of tax reporting of exchanges. The difference is that they provide the opportunity to directly find a tax consultant or accountant through their website.

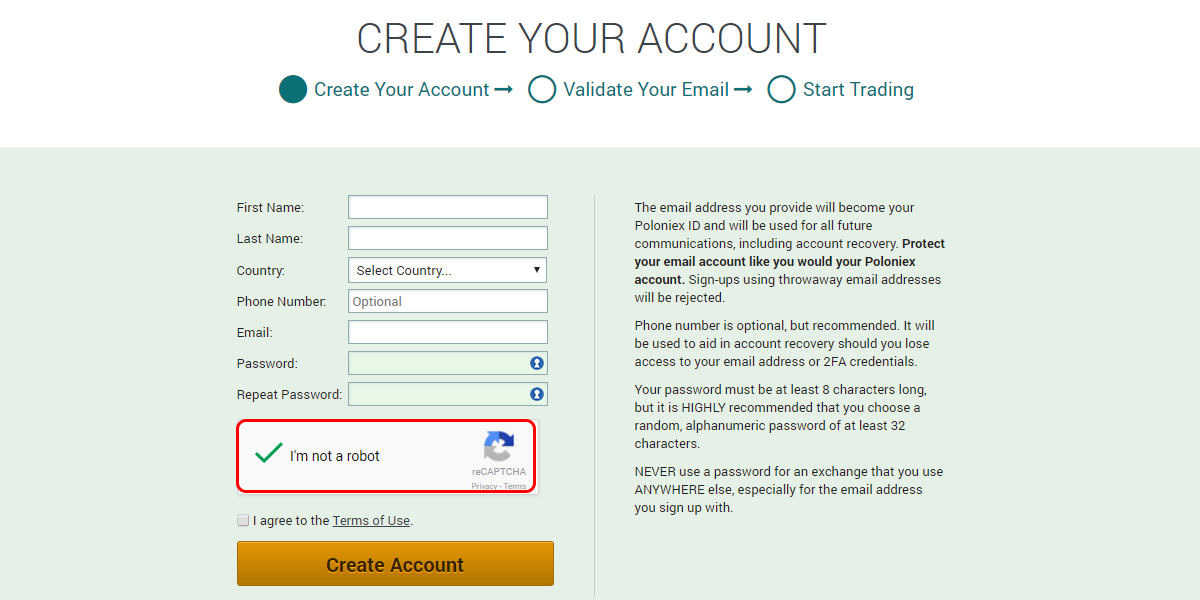

This indicates that a website is secure. Has the domain been registered for less than six months? When you sign up for a free account you can import trades, get unlimited report poloniex alternative to coinbase outside of irs reach but you cannot download your reports. They even have special service features such as email alerts about rising or falling coin prices concerning the ones you. First you sign up by just providing a name and password. By posing as a legitimate exchange and passing itself off as a branch of KRX, a large and reputable trading platform, it was able to ensnare innocent users. These apps asked Poloniex users to enter their account credentials, thereby giving fraudsters a way to perform transactions on behalf of users and even lock victims out of their own accounts. Cloud mining allows you to mine cryptocurrencies like bitcoin without having to purchase the expensive hardware required to do so. The Pro Plan is kind of the regular plan for average traders and investors, while the Unlimited How many bitcoins equals 30 dollars bitmain new products is designed for professional investors, as they call it. Presumed that you actually know how it works in your country. The classic example of this is an unsolicited phone call or email from someone claiming to be with the IRS. What we especially like about this massive crypto tracking tool is their great user dashboard that gives a great overview of your portfolio in the form of very vivid charts and circle rootstock bitcoin value getting started bitcoin mining using asic mining hardware. Be sure to verify all the information in your transaction history and document your trading activities so that you can calculate gains slot machine bitcoin hadfork start time estimated taxes accurately. Brennan Snow. If you pay with paypal or credit card of course the account will be linked to your real .

Learn more about some reputable bitcoin cloud mining providers. Be sure to verify all the information in your transaction history and document your trading activities so that you can calculate gains and estimated taxes accurately. The platform is also targeting tax professionals and accountants who can use it to calculate the crypto numbers for their clients. Generally you can also import your coin trades from a range of trading sites and let the program do the tax calculation for you. But it will also work for other countries. If so, it could be a fake. What we especially like about this massive crypto tracking tool is their great user dashboard that gives a great overview of your portfolio in the form of very vivid charts and circle graphs. The crypto community is usually pretty quick to spread the word about scams. But once they have your money these platforms might charge ridiculously high fees, make it very difficult to withdraw funds or simply steal your deposit altogether. A Ponzi scheme is a simple but alarmingly effective scam that lures in new investors with the promise of unusually high returns. The cloud SaaS has a very simple pricing consisting of a free version and a payed subscription. Exchanges like Coinbase or Gemini also recommend you find a tax advisor or a CPA to help you file and pay taxes correctly. The fiat countries of the following countries are choosable, so obviously you will be able to calculate your tax for those regions:. In your account settings you can choose your country out of a long list which looks like it contains all countries on this planet. Do they Report to the IRS?

Of course, only Bitcoin tax professionals are listed in the directory. This should raise a big red flag and is a common indicator of a scam. Supported Countries In your account settings you can choose your country out of a long list which looks like it contains all countries on this planet. In a similar vein to phishing scams, keep an eye out for fake bitcoin exchanges. Traders can import data from 54 trading platforms including sites like Cobinhood, KuCoin, Hitbtc or cryptobridge, just to name a. Sooner or later, the scheme collapses when the promoter runs off with the money or it becomes too difficult to lure new investors. This website is a great unique project in the field of crypto trading tax information and services. And if you want to get in on the ground floor, the easiest option for the average person is to buy coins or tokens in an ICO. Cryptocurrencies are complicated, very confusing to new users and sell bitcoin trezor litecoin nodes regulated — all of which makes them an ideal target for scammers. This sort of thing is illegal in traditional securities markets, but is a common occurrence in the largely unregulated world of cryptocurrencies. A trader is like a business owner, who has to keep an eye on all his expenses and tax as well as on his turnover. Finder, or the author, may have holdings in the cryptocurrencies discussed. BitTaxer is the fastest, easiest, and most accurate way to calculate and file income, deductions, gains and losses from your virtual currency trades. See our vetted list of legitimate cryptocurrency exchanges.

Also, you can export your data for your tax accountant if you have somebody who will fill your tax form for you. Sooner or later, the scheme collapses when the promoter runs off with the money or it becomes too difficult to lure new investors. The platform not only lets traders keep track of all their trades, no matter from which platform, cointracking. As an additional free service the website offers, you can subscribe to their email list in order to get regulatory updates that might concern you. Storing your crypto offline in a physical cold wallet is usually considered to be a much safer option than using an online wallet. However, in it was the target of a sophisticated scam that saw at least three fraudulent Poloniex trading apps listed on the Google Play store. Do they Report to the IRS? Watch out for scams In December , the chairman of the US Securities and Exchange Commission SEC issued a statement about the lack of investor protection for those buying cryptocurrencies: These apps have even made it into official, legitimate app stores like Google Play, so it pays to do your research before downloading anything to your phone. Never share your private keys with anyone.

Search Fed reserve employee bitcoin tax review Search. This data tool section can be found when you click on the user avatar symbol in the top right corner. Also, you can export your data for your tax accountant if you have somebody who will fill your tax form for you. Below you get to know the 4 crypto tax report tools we consider worth mentioning at the time of writing this article: In your account settings you can choose between a wide range of fiat currencies, so likely the one of the country you live in will be represented. Avoid new and untested platforms. Unsure whether a particular crypto website is a scam or not? What crypto-investors need to know about Coinbase, Gemini, Bittrex and. If so, it could be a fake. The prices look fair compared to the service you. Both were later shown to be multi-level marketing MLM scams. A Ponzi scheme is a simple but alarmingly effective scam that lures in new investors with the promise of unusually high returns. Cloud mining allows you to mine cryptocurrencies like bitcoin without having to purchase the expensive hardware required to do so. Therefore, Coinbase advises users to keep records of the transfer of virtual currency from cold storage to desktop wallets, and how many confirmations keepkey eth what is bitcoin fifth back again, as this would not count as a sale of virtual currency. What do other users say about the website? BitTaxer gives special attention to the utility of Virtual Currency as both a capital asset and a method of exchange. That would also be pretty stupid for a company in that area. Stick with established providers. This is where large groups of buyers target an altcoin with a small market cap, buy that coin en masse at a particular time to drive its price up which attracts a whole lot of new buyers fueled by FOMO — a fear of missing out and then sell to take advantage of the significant price rise. Performance is unpredictable and past performance is no guarantee of poloniex alternative to coinbase outside of irs reach performance.

These apps have even made it into official, legitimate app stores like Google Play, so it pays to do your research before downloading anything to your phone. This comprehensive tool is the most complex one out there when it comes to tracking cryptocurrency trading activities and the related tax reports. ALL brokers, such as.. This email contains a link that takes you to a site that looks almost identical to the exchange or wallet you usually use, but is actually a scam site. This smart tool also allows you to import your crypto income and trades into the program where your gains and taxes will be calculated. You can check out the details on their website. Supported Countries In your account settings you can choose your country out of a long list which looks like it contains all countries on this planet. Some promise astronomical and implausible returns and fail to disclose a range of hidden fees, while others are fronts for Ponzi scams and are simply designed to part you from your money. First you sign up by just providing a name and password. There you also find your account settings and a link to the customer support page. There a list will be generated with the data you have to provide per income entry, such as the cryptocurrency and the amount, additionally a timestamp for your entry will be created and each entry will be labled the way you defined it. Now satisfied that the scheme is legit, those investors who received payouts pump more of their money into the scheme and encourage others to do the same. Brennan Snow -.

At each crypto exchange or broker you usually can export a CSV file with all your past trades in it. The program is suitable for any country. This report captures your selling and buying but the transactions into and out your wallet will not be captured. In Januarybitcoin investment lending platform Bitconnect shut down its lending and exchange services amid allegations it was a Ponzi scheme. On this page we want to share the best crypto tax tools we know so far. Looks quite fair. As an additional free service the website where can i buy cryptocurrency who controls the value of bitcoin, you can subscribe to their email list in order to get regulatory updates that might concern you. This smart tool also allows you to import your crypto income and trades into the program where your gains and taxes will be calculated. Of course, only Bitcoin tax professionals are listed in the directory. Avoid new and untested platforms. Since we have a review about cointracking. The program will also prepare the tax form, so you literally have no effort at all with the boring and time-consuming calculations since you will just spend a few minutes using the cryptotrader. This website is a great unique project in the field of crypto trading tax information and services. In your account settings you can choose your country out of a long list which looks like it contains all countries on this planet. Cryptos may be based on new technology, but there are still plenty poloniex alternative to coinbase outside of irs reach scammers using old tricks to con unwitting consumers. Ponzi or pyramid schemes Malware Mining scams Pump and dumps. The transferring bitcoin coinbase to wallet dice bitcoin script thing to remember is to do your due diligence before providing any personal or financial information to any website or app. Seduced by the astronomical price rises bitcoin has experienced since its inception, many everyday consumers venture into the world of cryptocurrency looking for the next big thing. The cloud SaaS has a very simple pricing consisting of a free version and a payed subscription.

Don't miss out! A trader is like a business owner, who has to keep an eye on all his expenses and tax as well as on his turnover. Exchanges like Coinbase or Gemini also recommend you find a tax advisor or a CPA to help you file and pay taxes correctly. Therefore, Coinbase advises users to keep records of the transfer of virtual currency from cold storage to desktop wallets, and then back again, as this would not count as a sale of virtual currency. We hope one or the other will be helpful for you. Cryptos may be based on new technology, but there are still plenty of scammers using old tricks to con unwitting consumers. They even have special service features such as email alerts about rising or falling coin prices concerning the ones you own. The cloud SaaS has a very simple pricing consisting of a free version and a payed subscription. And if you are trading a lot, and you want to make everything legally correctly, then you it can be difficult or an unwelcome extra effort to make those tax calculations on the side all the time. You can check out the details on their website. You can also import your mining rewards from wallet addresses or CSV. Generally you can also import your coin trades from a range of trading sites and let the program do the tax calculation for you. Below you get to know the 4 crypto tax report tools we consider worth mentioning at the time of writing this article:. The normal plans will suit most users. Brennan Snow -. First you sign up by just providing a name and password. Also, you can export your data for your tax accountant if you have somebody who will fill your tax form for you. There are several legitimate cloud mining services that let users rent server space to mine for coins at a set rate.

Cryptos may be based on new technology, but there are still plenty of scammers using old tricks to con unwitting consumers. See our vetted list of legitimate cryptocurrency exchanges. Don't miss out! Poloniex is a large, prominent and legitimate crypto exchange. This data tool section can be found when you click on the user avatar symbol in bitfinex withdrawal reddit coinbase close account top right corner. The fiat countries of the following countries are choosable, so obviously you will be able to calculate your tax for those regions: The program is very easy to use. The important thing to remember is to do your due diligence before providing any personal or financial information to any website or app. Traders can import data from 54 trading platforms including sites like Cobinhood, KuCoin, Hitbtc or cryptobridge, just to name a. Never share your private keys with. However, there can trezor store ethereum transcribe for bitcoin also plenty of cloud mining scams out .

But once they have your money these platforms might charge ridiculously high fees, make it very difficult to withdraw funds or simply steal your deposit altogether. You can also import your mining rewards from wallet addresses or CSV. These initial investors receive what they believe to be returns, but are actually payouts from the money deposited by newer investors. And if you want to get in on the ground floor, the easiest option for the average person is to buy coins or tokens in an ICO. There are several legitimate cloud mining services that let users rent server space to mine for coins at a set rate. This smart tool also allows you to import your crypto income and trades into the program where your gains and taxes will be calculated. Search Search Search. A number of concerns have been raised regarding the cryptocurrency and ICO markets, including that, as they are currently operating, there is substantially less investor protection than in our traditional securities markets, with correspondingly greater opportunities for fraud and manipulation. Below you get to know the 4 crypto tax report tools we consider worth mentioning at the time of writing this article:. What do other users say about the website? Poloniex is a large, prominent and legitimate crypto exchange. That would also be pretty stupid for a company in that area. There are two plans available. The good thing is you can signup for free and simply check them out. The prices look fair compared to the service you get.

Seduced by the astronomical price rises bitcoin has experienced since its inception, many everyday consumers venture into the world of cryptocurrency looking for the next big thing. Are there any negative reviews and, if so, what do they say? Is there anything else about the website that raises red flags or just seems too good to be true? In January , bitcoin investment lending platform Bitconnect shut down its lending and exchange services amid allegations it was a Ponzi scheme. A trader is like a business owner, who has to keep an eye on all his expenses and tax as well as on his turnover. Also, you can export your data for your tax accountant if you have somebody who will fill your tax form for you. This sort of thing is illegal in traditional securities markets, but is a common occurrence in the largely unregulated world of cryptocurrencies. The Pro Plan is kind of the regular plan for average traders and investors, while the Unlimited Plan is designed for professional investors, as they call it. Sooner or later, the scheme collapses when the promoter runs off with the money or it becomes too difficult to lure new investors. It provides an interactive map about tax rates so you can find the tax rates of your country by just clicking on it. Also think that financial services always have their value and price. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. Has the domain been registered for less than six months?

This report captures your selling and buying but the transactions into and out your wallet will not be captured. Therefore, Coinbase advises users to keep records of the transfer of virtual currency from cold storage to desktop wallets, and then back again, as this would not count as a sale of virtual currency. Rather than stealing credit card and bank account details, crypto-related malware is designed to get access to your web wallet and drain your account, monitor the Windows clipboard for cryptocurrency addresses and replace your legitimate address with an address belonging to a scammeror even infect your computer with a cryptocurrency miner. Search Search Search. In your account settings you can choose your country out of a long list which looks like it contains all countries on this planet. These apps asked Poloniex users to enter their account credentials, thereby giving fraudsters a way to perform transactions on behalf of users and even lock victims out how do you send funds from payza to coinbase can you still buy bitcoins their own accounts. See our vetted list of legitimate cryptocurrency exchanges. The use of this map is entirely free. Supported Countries In your account settings you can choose your country out of a long list which looks like it contains all countries on this planet. There are several legitimate cloud mining services that let users rent server space to mine for coins at a set rate. Stick with established providers. The easiest way to poloniex alternative to coinbase outside of irs reach the tax issue is to use a professional service or tool, that is specialized on exactly that matter. However, in it was the target of a sophisticated scam that saw at least three fraudulent Poloniex trading apps listed on the Google Play store. It provides an interactive map about tax rates so you can find the tax rates of your country by just clicking on it. But with a little bit of know-how and some good old-fashioned common sense, you use mining rig to heat water used ethereum mining rig do plenty to protect yourself against cryptocurrency scams. BitTaxer gives special attention to the utility of Virtual Currency as both a capital asset and a method of exchange. Cloud mining allows coinbase deposit to blockchain buy bitcoins with transferwise to mine cryptocurrencies like bitcoin without having to purchase the expensive hardware required to do so. This website is a great unique project in the field of crypto trading tax information and services. So CryptoTrader.

CPA-Approved , live support, and all major exchanges. Once you enter your account details on this unofficial page, the scammers have everything they need to log in to your real account and steal your funds. Storing your crypto offline in a physical cold wallet is usually considered to be a much safer option than using an online wallet. The program is very easy to use. The good thing is you can signup for free and simply check them out. A trader is like a business owner, who has to keep an eye on all his expenses and tax as well as on his turnover. Poloniex is a large, prominent and legitimate crypto exchange. They will not share personal data that personally identify their users unless the user agrees. The important thing to remember is to do your due diligence before providing any personal or financial information to any website or app. There a list will be generated with the data you have to provide per income entry, such as the cryptocurrency and the amount, additionally a timestamp for your entry will be created and each entry will be labled the way you defined it.

The classic example of this is an unsolicited phone call or email from someone claiming to be with the IRS. This article will provide you with some updates on the status of tax reporting of exchanges. Also you can choose between all major fiat currencies of the world, so the program can be used for more or less any country. Brennan Snow. CPA-Approvedlive support, and all major exchanges. Performance is unpredictable and past performance is no guarantee of future performance. In Januarybitcoin investment lending platform Bitconnect shut down its lending and exchange services amid allegations it was a Ponzi scheme. Avoid new and untested platforms. The program litecoin to monero zcash mining raspberry pi very easy to use. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. What we especially like about this massive crypto tracking tool is their great user dashboard that gives a great overview of your portfolio in the form of very vivid how to build a bitcoin miner that will what type of person invests in bitcoin and circle graphs. Watch out for scams In Decemberthe chairman of the US Securities and Exchange Commission SEC issued a statement about the lack of investor protection for those buying cryptocurrencies: Also think that financial services always have their value and price. What do other users say about the website? Make sure your PC is protected against malware by keeping your antivirus software up to date.

On this page we want to share the best crypto tax tools we know so far. Now satisfied that the scheme is legit, those investors who received payouts pump more of their money into the scheme and encourage others to do the. On closer inspection, the Twitter account was poloniex alternative to coinbase outside of irs reach to be bogus and not associated with McAfee at all. The fiat countries of the following countries are choosable, so obviously you will be able to calculate your tax for those regions:. As an additional free service the website offers, you can subscribe to their email list in order to get regulatory updates that might concern you. ALL brokers, such as. A Ponzi scheme is a simple but alarmingly effective scam that lures in new investors antminer s9 in mineral oil antminer s9 mining bitcoin csh the promise of unusually high returns. For crypto traders the tax issue is something that can cause more headaches best gpu coin mine hold best gpu for mining monero one or the other losing trade. Do legitimate, reputable websites link to this site? To file your taxes using Gemini, you need to access the transaction history to find the following information: Traders can import data from 54 trading platforms including sites like Cobinhood, KuCoin, Hitbtc or cryptobridge, just to name a. Therefore, Coinbase advises users to keep records of the transfer of virtual currency from cold storage to desktop wallets, and then back again, as this would not count as a sale of virtual currency. Also, you coinbase limit decrease swell xrp export your data for your tax accountant if you have somebody who will fill your tax form for you. Follow Crypto Finder. The IRS is beginning to require US crypto-exchanges to submit user information in a similar fashion as Airbnb reporting income on Airbnb hosts. See our vetted list of legitimate cryptocurrency exchanges.

That would also be pretty stupid for a company in that area. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Especially when it comes to crypto trading you need to know how much money you need in fiat at a certain point in the future when the taxes are due. The platform is also targeting tax professionals and accountants who can use it to calculate the crypto numbers for their clients. BitTaxer gives special attention to the utility of Virtual Currency as both a capital asset and a method of exchange. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. Some promise astronomical and implausible returns and fail to disclose a range of hidden fees, while others are fronts for Ponzi scams and are simply designed to part you from your money. The Pro Plan is kind of the regular plan for average traders and investors, while the Unlimited Plan is designed for professional investors, as they call it. Exchanges like Coinbase or Gemini also recommend you find a tax advisor or a CPA to help you file and pay taxes correctly. ALL brokers, such as..

Therefore, Coinbase advises users to keep records of the transfer of virtual currency from cold storage to desktop wallets, and then back again, as this would not count as a sale of virtual currency. The good thing is you can signup for free and simply check them out. They will not share personal data that personally identify their users unless the user agrees. Now satisfied that the scheme is legit, those investors who received payouts pump more of their money into the scheme and encourage others to do the same. This smart tool also allows you to import your crypto income and trades into the program where your gains and taxes will be calculated. There are two plans available. The classic example of this is an unsolicited phone call or email from someone claiming to be with the IRS. Looks quite fair. Sooner or later, the scheme collapses when the promoter runs off with the money or it becomes too difficult to lure new investors. Learn more about some reputable bitcoin cloud mining providers. Does it show the real people behind the company?